“Fool me once, shame on you; fool me twice, shame on me,” has been around since the 15th century. Christened by English courtier Sir Anthony Weldon in 1651, “The Court and Character of King James” gave us: “The Italians have a Proverb, ‘He that deceives me once, it’s his fault. He that deceives me twice, it’s my fault.’” Four centuries later, the 43rd U.S. president infamously adapted Weldon’s idea, inspired by yet another U.K. rock star, or should we say, stars -- The Who. As George W. Bush infamously said, “Because we’re trying to figure out how best to make the world a peaceful place…There’s an old saying in Tennessee, I know it’s in Texas, probably in Tennessee, that says ‘Fool me once, shame on...shame on you. Fool me...’ You can’t get fooled again. We’ve got to understand the nature of the regime we’re dealing with.”

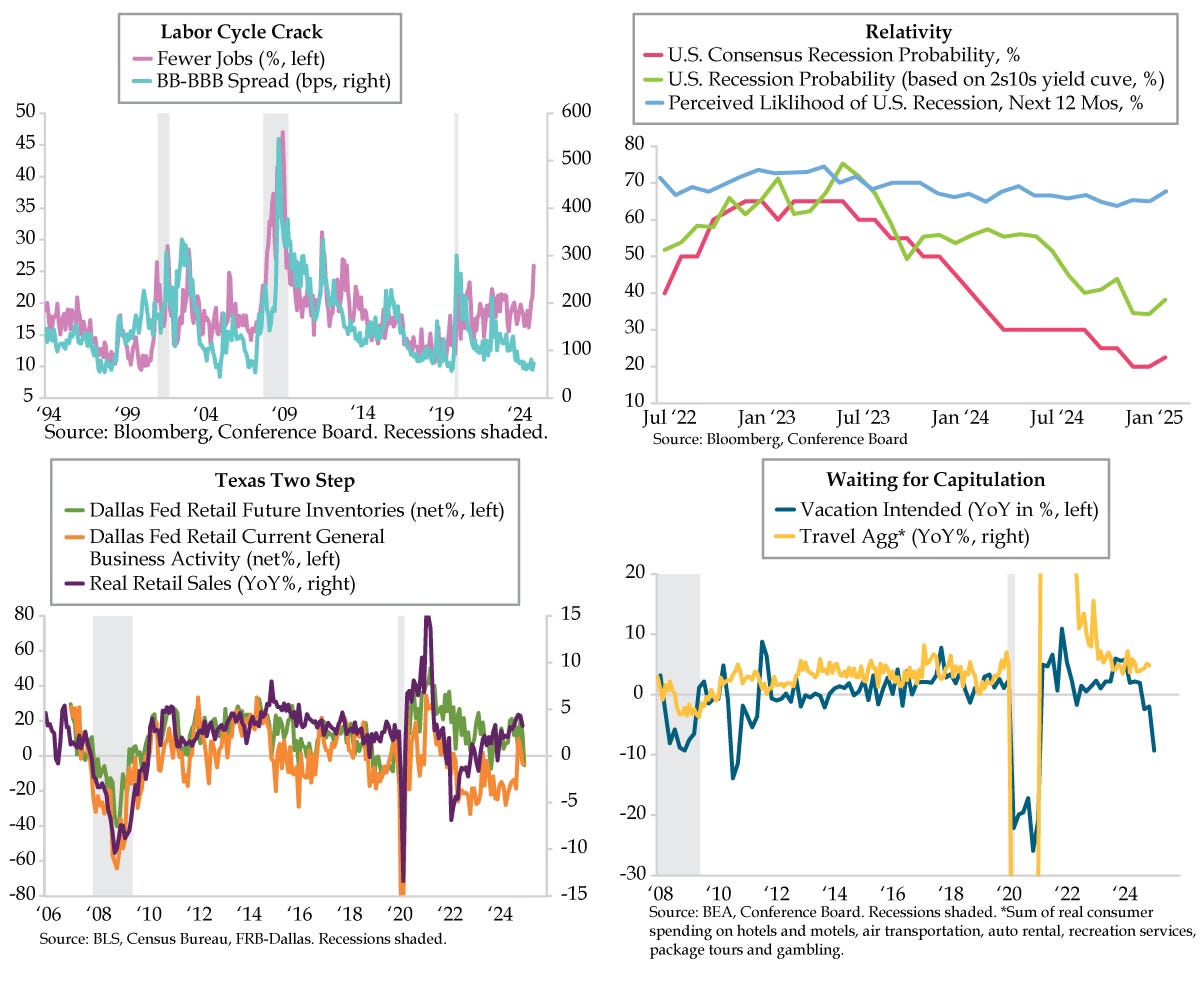

U.S. govie traders aren’t prone to being fooled. Two sizable disappointments from both major U.S. consumer surveys in the span of three trading sessions have doubly emphasized recession risks. Citi’s U.S. economic surprise index flipped negative, adding conviction to the momentum. Using the global risk-free rate as a guide, the three-day 30-basis-point (bp) decline in the yield of the 10-year Treasury yield was mainly by the decline in real yields, a reflexive reaction to a growth slowdown narrative gaining traction.