We did it!! We scored one for the little gal and guy!

On October 19, 2022, QI published, “The Land of the Bleed & The Home of the Greed,” which you can read in full at this link. As I wrote then, “In March 2010, eight months after the Great Recession had ended, the United States Internal Revenue Service (IRS) issued a record $24 billion in business income tax refunds. Great losses had been tallied leading to a massive relief in tax refund monies paid out to businesses, millions of which did so when the window opened on January 15, 2010. In the 20 months following February 2020, a total of $156 billion was paid out in business income tax refunds. This year, the IRS opened the till on January 24th. But that date was beyond irrelevant. The minute the CARES Act was signed into law on March 27, 2020, the biggest tax party in U.S. history kicked off. It hasn’t ended.”

In studying the data, QI’s Dr. Gates and I had uncovered what appeared to be a massive slush fund: “And then there’s the stimulus monies that never seem to stop flowing as evidenced by the quiet $200-plus billion that’s been pumped into the hands of U.S. consumers thanks to business income tax refunds that are amazingly not covered by the media.”

After we published, we were so excited, we started talking to clients about it. There was a bona fide reason the economy hadn’t slipped into recession – pandemic relief stimulus checks were still being directly deposited. Inflation was still being generated by fresh cash infusions. The media just wasn’t reporting on it.

As for our clients, any mention of the Employee Retention Credit, was answered with, “The Employee WHAT?” In the beginning, the chop shops were just a little greedy. But the current administration’s expansion of the program to include companies formed after the pandemic was too attractive a prospect to resist. The $$$ flashed before the eyes of those who’ve always been inclined to grift. And so it began in earnest…with a TV ad on Super Bowl Sunday.

Before too long, the ad dollar floodgates had been thrown wide open, especially for the financial media. Heck, at the time of this writing, two hours after The Wall Street Journal released “IRS Shuts Door on New Pandemic Tax Credit Claims Until at Least 2024,” at 2:30 pm ET, Bloomberg had still not published its own story. Far be it for us to say, but there were likely some behind-closed-doors chats underway as Bloomberg TV and Radio ran ERC ads nonstop. There wasn’t a morning that went by that Tom Keene wasn’t lauding Innovation Taxes, one of the two biggest hawkers of the program. Why else not say a peep on a program that pumped hundreds of billions into the economy, in cash, after CNBC and the New York Times had reported on the major business story? Full disclaimer: In the last six months, three media outlets interviewed me extensively on the ERC. Only Yahoo Finance reported the findings.

Neither here nor there, we say. We knew (thanks to you, our clients) our research was spreading through Congress. Once the light bulb went off over clients’ heads, they became our ambassadors. WE THANK YOU. And then there’s Danny, who we really want to meet just to shake his hand. Daniel “The Commish” Werfel fought bravely to pull the plug on the ERC and we can’t thank him enough.

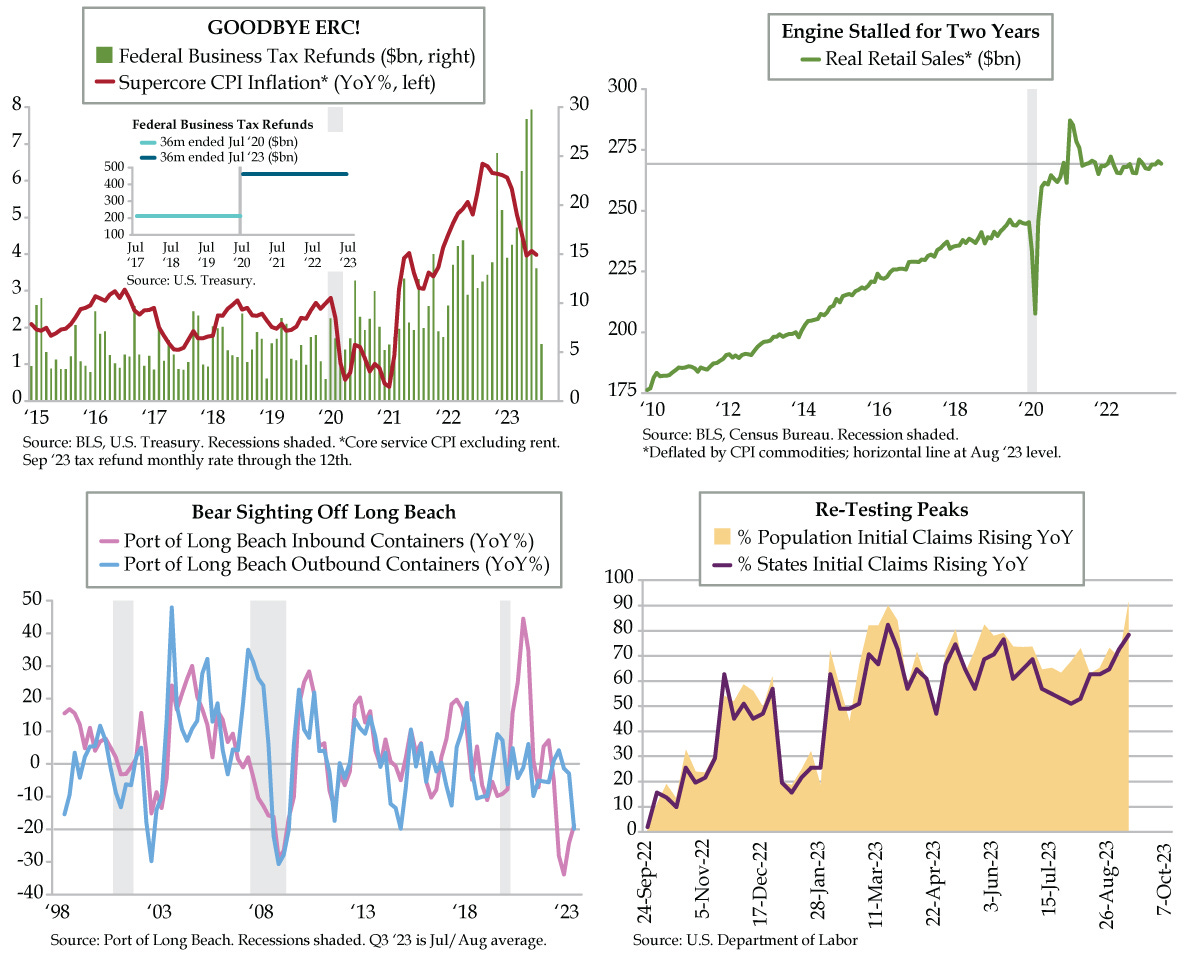

For what it’s worth, we knew something was up last month when business income taxes paid were more than halved, to $13.6 billion from July’s record $29.8 billion. As of September 13th, the month’s run rate was $5.5 billion. While we will see upward pressure on Powell’s supercore inflation when healthcare is realistically reflected beginning in October, the arresting of the ERC should act as a massive offset (upper left chart).

Broadening out, we’re certain that without the $413 billion in business income tax refunds pumped into the economy since May 2021, inflation-adjusted Retail Sales would have fallen by now. Since peaking at $285 billion the month the third stimulus check was directly deposited into household bank accounts – April 2021 – real Retail Sales have averaged $269 billion a month, exactly where they came in last month. Flat as a pancake for 27 months (upper right chart). Tell us the ERC doesn’t fill in a blank. And then tell us what U.S. consumption would have been since then.

Now, without this ERC prop, with student loans restarting, a government shutdown looking likely, the UAW striking, credit standards tightening, the bankruptcy cycle in full gear, the global economy in recession, and Powell on a warpath to murder the Fed Put, is it any wonder port volumes on the West Coast have collapsed to levels not seen since the Great Financial Crisis (lower left chart)? Should we be surprised that initial jobless claims have fanned out across the country, encompassing 78% of states in which 91% of the population resides (lower right chart)? Many redundant questions from one heck of an excited writer who knows her birthday came four days early this year. Scoring one for hardworking Americans is, I must say, the best gift I’ve ever received. WE WON!!!

At 5:00 pm ET, Bloomberg Tax Automation (AI) published “IRS News Release: IRS Warns Businesses of Aggressive Marketing of Employee Retention Credit.”

Thank you very much!

AGREED!