We don’t do this often — share fresh research we historically keep behind the pay wall for much longer. That said, the groundbreaking research we’ve done at QI never ceases to shock those who can’t figure out why the U.S. economy has kept chugging along even as Uncle Sam APPEARED to be reining in fiscal stimulus. In fact, the spigot has never been turned off. The sad part is, the U.S. taxpayer money that continues to get directly deposited is only benefitting the wealthiest Americans.

Please join the QI Research community so you can be among the most informed clients on and off the Street.

Have a great weekend.

Danielle

On February 25, 1791, George Washington signed into law a bill establishing the first Bank of the United States. Treasury Secretary Alexander Hamilton lobbied for support for the bank on the premise that a national bank was “a political machine, of the greatest importance to the state.” The federal government had recently assumed states’ Revolutionary War debts and was desperate to collect taxes to bring revenues into the nation’s coffers. Hamilton was countered by Secretary of State Thomas Jefferson and Representative James Madison of Virginia who argued that the Constitution did not expressly grant Congress the authority to establish a national bank; that power was under the purview of the states. Because Southern states had far less war debt than their northern counterparts, they bartered to relocate the nation’s capital to a more easily accessed locale – the freshly created District of Columbia. The charter had only been granted, however, for 20 years, after which time Congress let it lapse. This process resumed in 1816 when Congress created a second bank of the United States; it too lapsed into nonexistence 20 years later during Andrew Jackson’s presidency. As we know, the central bank of the United States was not created until 1913.

Public awareness of the Federal Reserve has never been higher. The release of the Fed’s H.4, which breaks out the composition of the balance sheet, has even been added to economic calendars. Yesterday, we learned that the banking crisis continues to dissipate. In the week through April 12, loans made through the Discount Window shrank to $67.6 billion, down from the record $152.9 billion last month. Meanwhile, outstanding borrowing from the Bank Term Funding Program fell to $71.8 billion from the last week’s peak of $79 billion. According to the New York Fed, the game plan is to keep shrinking the Fed’s balance sheet from $8.6 trillion to $6 trillion by the end of 2025 and then hit the pause button.

As for the other banks in the United States, we will begin to hear from them today as they kick off the first quarter earnings season in earnest. If we use the Great Financial Crisis as a guide, we could be looking at analysts taking down their earnings estimates for six straight quarters. The Fed says the economy is likely to enter a “mild recession” so maybe it won’t be so bad after all. File that one under “I’ll believe it when I see it.”

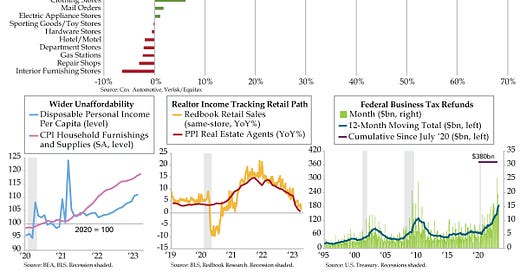

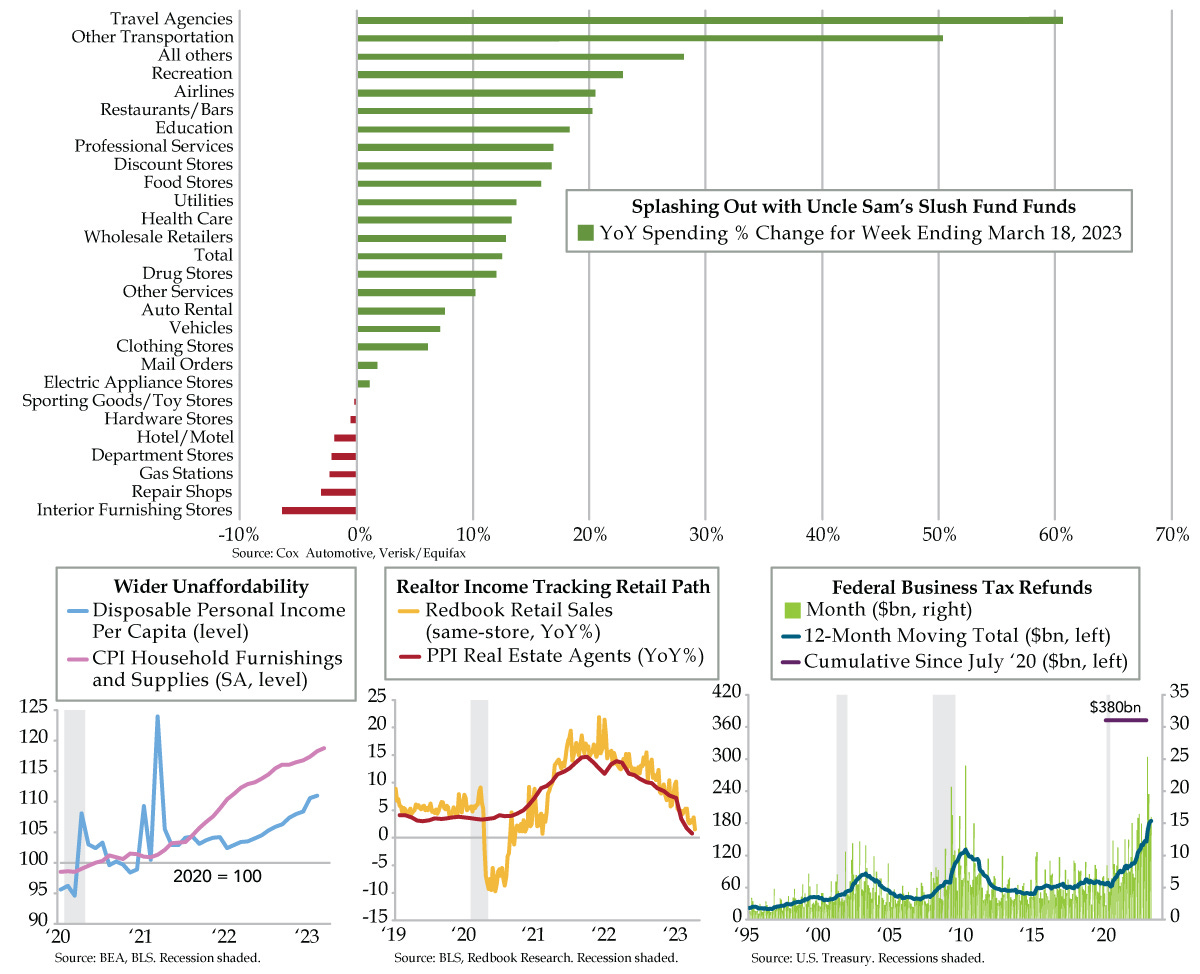

And yet, we know Americans continue to spend. Data in the week through March 18th shows U.S. households are splashing out on travel and eating out (top graph). There’s a reason for that. One of the reasons so many were calling for recession, myself included, after the lion’s share of fiscal spending had been directly deposited in consumers’ bank accounts, is that they were unaware that those direct deposits had done anything but disappear. In what I call the quietest tax break for wealthy Americans to go unreported, business income tax refunds have swelled to $380 billion since July 2020 (lower right chart). Why that time stamp? That was the first month U.S. businesses could claim the Employee Tax Credit (ERC), which provides up to $26,000 in payroll tax clawbacks for every employee on a given company’s payroll. Care of the CARES Act, all you need to do is demonstrate your business was interrupted due to Covid.

The dirty little secret is that Biden’s stimulus bill extended the CRE to apply to any disruption through 2021’s third quarter. In what’s become a cottage industry, companies aggressively solicit their tax services on an effective contingency basis, which is anything but kosher. Sadly, these firms turn away the smallest businesses who actually need the extra cash as they don’t get to collect as much of their “fee.” To give you a feel for the scope of the slush fund, in the 33 months preceding July 2020, a grand total of $190 billion was sent out in business income tax refunds. Yes, double the rate. Employers have until 2025’s third quarter to claim their “fair” share of slush. The “tax consultants” have had to increase their advertising spending, which tells you they are slowly draining the pool of eligible employers. But it’s still big money. If you look past December’s $25.4 billion record, you see that in March the $15.9 billion in taxpayer dollars shelled out was one of the biggest months in the history of the series.

What households are not buying, which is evident in the increasingly panicked email barrage for massive sitewide sales, is furniture stores. As the CEO of Restoration Hardware can attest, U.S. households are tapped out when it comes to outfitting their homes. That’s what happens when you pull demand forward. Perhaps now, the high boil on furniture inflation can cool as it’s been running well north of disposable income (lower left chart).

Housing has also hit a wall as you can see through the prism of realtors’ income as gauged by the producer price index for this cohort veering into contraction (red line). It stands to reason given Americans are stuck like glue to their 3% mortgages. That said, the recession will force the hands of Airbnb mortgagees that are levered to the hilt. Department store sales have also fallen into the red (yellow line) and flash a warning on services spending once the slush fund is depleted. The central bank of the United States will have its work cut out for it.