Ricky Bobby wasn’t the first to live by the creed, that “If you ain’t first, you’re last.” On June 27, 1967, just shy of its 300-year anniversary, Barclays Bank finally beat out its rival, C. Hoare & Co, which was founded in 1672 and is Britain’s oldest private bank. Barclays didn’t hang its shingle for another 18 years. Thanks to the frustration of John Shepherd-Barron, a Scottish engineer, Barclays stakes claim as the first bank to offer its clientele the convenience of an Automated Teller Machine. Annoyed that he couldn’t cash checks after business hours and inspired by a chocolate vending machine, Barron worked with banknote manufacturer De La Rue to create the first six automated cash dispenser machines. They were just in the nick of time as a Swedish competitor rolled out its versions nine days later. As for the United States, two years later, Dan Wetzel, an executive at Dallas-based Docutel, came up with his answer to the ATM. Rather than chocolate, his work developing automated baggage-handling equipment was his inspiration. The 1969 U.S. debut took place at a Rockville Centre, New York branch of Chemical Bank.

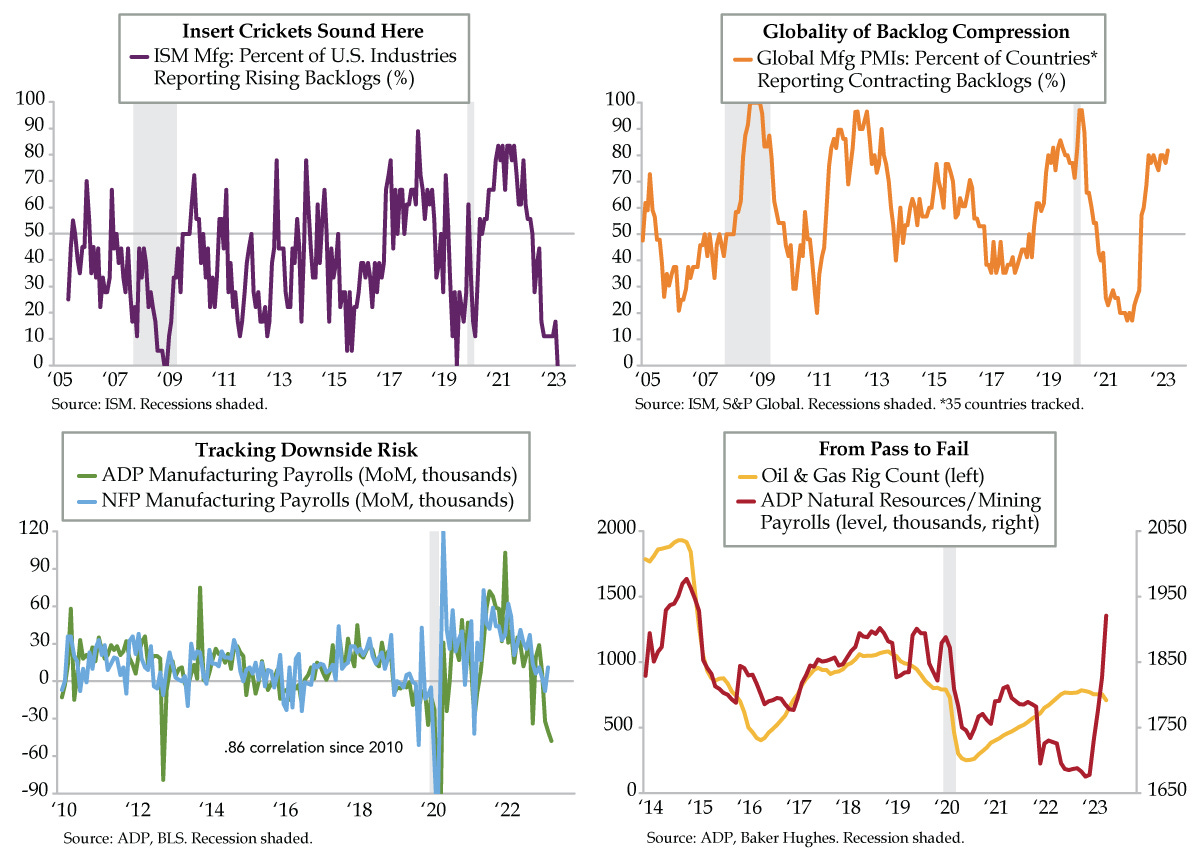

Neither Docutel nor Chemical Bank survived the test of time. On Thursday, Diebold Nixdorf, the Ohio-based largest maker of ATMs followed its predecessor into insolvency. It was one of three companies including cancer-treatment firm GenesisCare and Wesco Aircraft Holdings with more than $50 million in liabilities to file Chapter 11 yesterday. Add to that tally Retailing Enterprises LLC, a Florida-based retailer the South Florida Business Journal reported has “nearly $50 million in debt.” While it may be Nonfarm Payrolls Friday, we wouldn’t be shocked to see more labor market strength advertised in the Bureau of Labor Statistics (BLS) serially corrupted data despite bankruptcy filings at the highest level since the Great Financial Crisis (GFC). While the headlines have been spurious of late, the BLS can’t obfuscate the entire report. Luckily, we do know where to dig when the data hits as it did at 8:30 am ET.