The Daily Feather — Powell’s Sound of Silence

How impressionable were you when you were a 21-year-old man? In 1964, Paul Simon was feeling the angst of youthful alienation: “I used to go off in the bathroom because the bathroom had tiles, so it was a slight echo chamber. I’d turn on the faucet so that the water would run – I like that sound, it’s very soothing to me – and I’d play…in the dark.” Such was the unique space in which Simon wrote “The Sound of Silence.” What few know is that there are two versions, the first of which was such a dud, Simon and Art Garfunkel were compelled to disband after it was released on the duo’s debut album Wednesday Morning, 3 A.M.The acoustic album didn’t do it for a public whose tastes were undergoing a massive evolution. Little did they know that “Silence” was getting increased airplay. There was something about it. And so, the song’s producer, unbeknownst to the musicians, rearranged the song, adding drums and electric guitars. The 1965 re-release of the song is the iconic song we know today. Reunited, Simon & Garfunkel went on to craft the most enduring folk music the world has ever known.

At 3:02 pm ET yesterday, the sound of silence hit me like a brick. “Randy!” I asked one of QI’s PRO clients in our Bloomberg chat room, “When was the last Day After Fed Day with NO FED SPEAKERS?” To this Randy replied, “It does seem weird. There are usually several scheduled to fix whatever Powell said the day before.” It almost made me wish the mystery that was the gift that kept on giving, that of Jim Bullard’s first out-of-the-gate CNBC interview the Day After Fed Day. Alas, there were no comments from the president of the St. Louis Federal Reserve or any other District. There were no governors on the wires, not a single Fed speaker. I thought out loud before moving on that, “This feels coordinated,” I wrote. The muzzling must have come from on high.

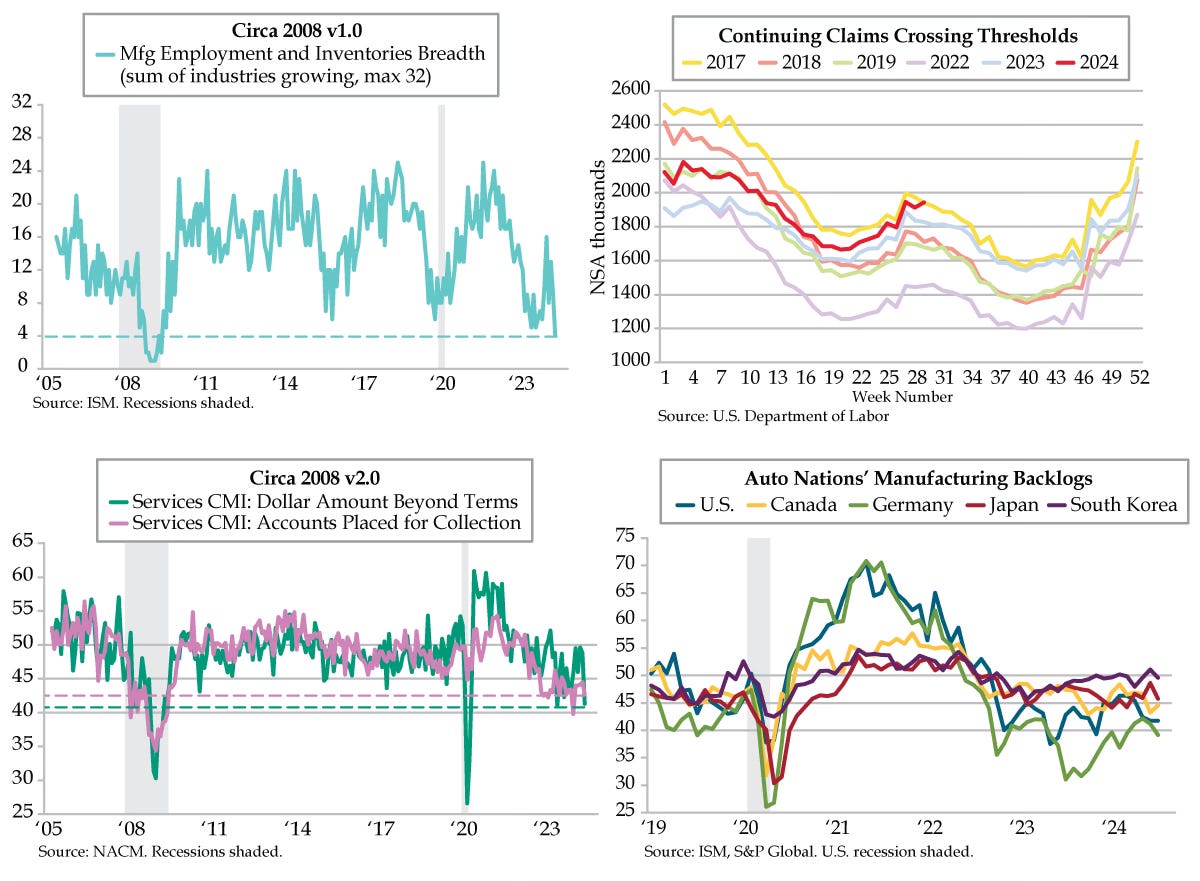

The next subject raised among QI’s institutional investors was that of the probability of an intermeeting emergency Fed rate cut. Yes, traders took less than 24 hours after Fed Chair Jerome Powell stepped down from the podium to segue from his dismissing the prospect of a 50-basis-point (bps) rate cut to betting the odds of a 50-bps cut made in haste to address an economy at risk of suffering an even Greater Recession than that weathered in the 18 months ended June 2009. THAT’S how bad yesterday’s data flow was, mocking Powell’s feigned inflation concerns. The “bad” began even before jobless claims hit with Truflation continuing its meltdown, to 1.38%. You don’t suffer a disinflationary heart attack unless something has seriously run off the rails in the economy. Folks, it was 1.92% on July 17th. That’s like two weeks ago!

“Danielle! You’re being overly dramatic!”