According to the U.S. Army, “The term ‘parade’ had various meanings to Continental Army troops camped at Valley Forge. It could mean to form, march, and drill. Early parades enabled commanders to give special instructions to subordinate leaders and to make command announcements. In the U.S. Army regulations of 1863, reviews were a type of parade, and ‘dress parades’ were conducted daily, except on extraordinary and urgent occasions. The parade remains basically the same as the review except that it has retained its original intent—a method whereby unit commanders could inspect troops, present awards, and issue information. The sequence of a parade has the following steps—formation of troops, sound off by a band, honors to the Nation, presentation, manual of arms, report, orders published, officers center, pass in review.”

Yesterday afternoon, on the shores of Lake Maxinkuckee, my youngest was one of six cadets firing two cannons for Battery A at Culver Military Academy. As a friend of ours, who hadn’t attended parade for a decade, commented of the patriotic synchronicity, “It never gets old.” With luck, General George Washington, who reviewed his troops at Valley Forge in December 1777, concurred from the heavens.

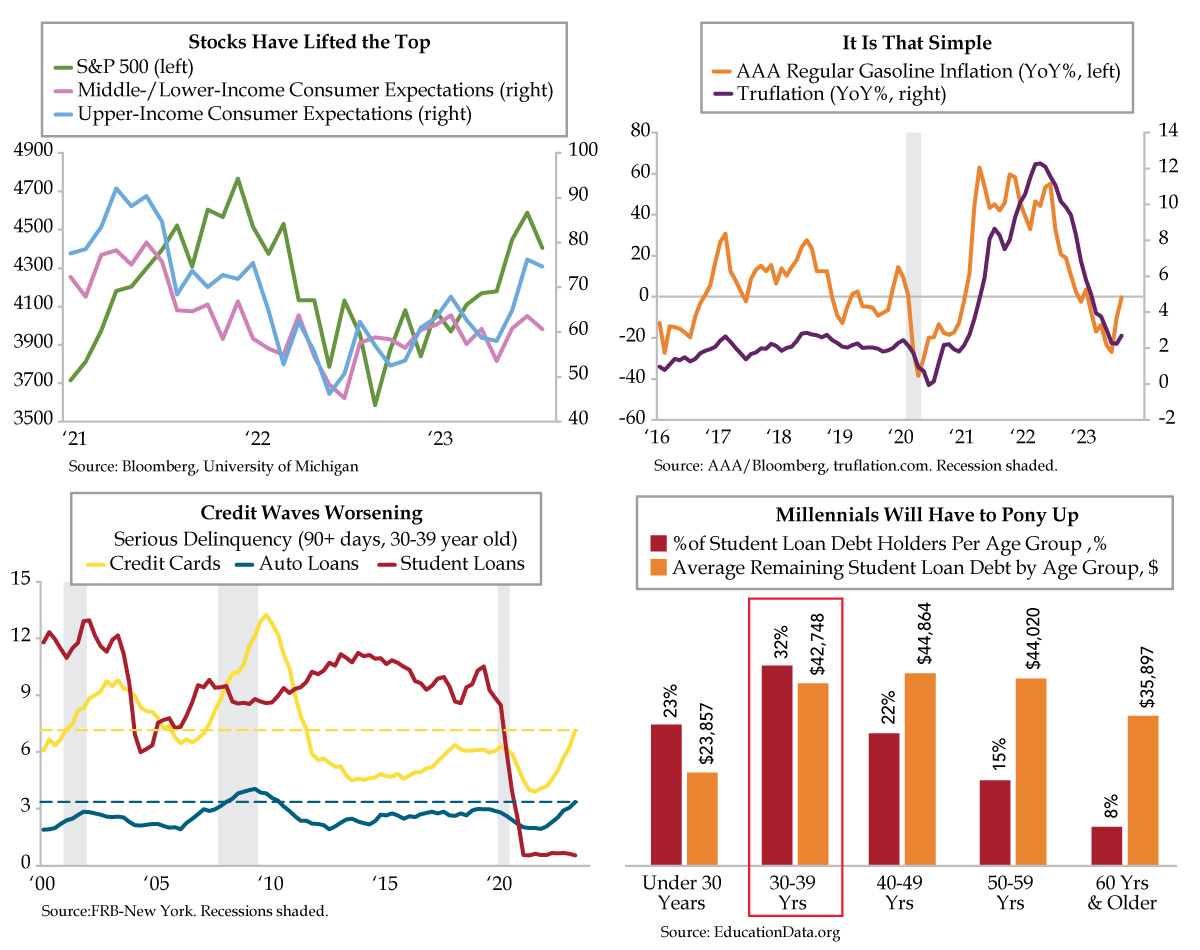

What does get old are graphical comparisons of the stock market and a countering series that defy history. In the last week, Bank of America’s Michael Hartnett highlighted three massive disconnects with respect to U.S. tech stocks: the value of global equities, G3 central bank liquidity, and as a percentage of the S&P 500’s market capitalization. As Hartnett expounded, “The best correlation of the past 15 years is central bank liquidity (insane surge from $5 trillion to $25 trillion & tech stocks (Nasdaq 2,000 to 16,000).