The Daily Feather — He-Who-Must-Not-Be-Named

“There is no good and evil. There is only power, and those too weak to seek it.”

June 19, 2021

His parents were miserable. He kept to himself. He terrorized his peers as a youth. He killed kitties. As Dumbledore warned that, “The young Tom Riddle liked to collect trophies. You saw the box of stolen articles he had hidden in his room. These were taken from victims of his bullying behavior, souvenirs, if you will, of particularly unpleasant bits of magic. Bear in mind this magpie-like tendency, for this, particularly, will be important later.” As prepared as he and Harry Potter were, catching He-Who-Must-Not-Be-Named was nearly impossible. The evilest character in modern history had split his soul into seven pieces and hidden six of them in “Horcruxes.” To kill him, all seven pieces must be destroyed rendering the slaying of Count Dracula child’s play by comparison. Etymological snobs that we are, J.K. Rowling’s pre-writing research is admirable – she improvised her antagonist’s name by creating a French compound marrying “vol,” “de,” and “mort,” or “flight or theft of death.” Such was the curse cast if one uttered his name, Death Eaters could immediately locate anyone who did utter his name.

We must admit to being surprised to learn that the author of the Harry Potter series was not the world’s most valuable author. Alas, Rowling’s meager net worth of $1 billion is a hair shy of that of Elisabeth Badinter. With an estimated net worth of $1.3 billion, the French philosopher made her lucrative stamp with titles including The Conflict: How Modern Motherhood Undermines the Status of Women. It’s her other day job that intrigued us – she is the majority shareholder of Publicis Groupe, an advertising and public relations behemoth her father founded in 1926 in a small apartment above a Parisian butcher’s shop. With roughly 75,000 employees worldwide, the world’s third largest ad agency said yesterday it expects to see revenue grow 3-5% this year and is hiring to support rising demand. In reaction to the robust report, the stock rose 4.5% in Thursday trading.

In stark contrast, Meta also reported yesterday that stiff competition from rivals including TikTok would continue to pressure its top line. The CFO of the parent of Facebook, Instagram, Messenger, and WhatsApp is Susan Li warned that the weakness in revenues was attributable to, “weak advertising demand, which we believe continues to be impacted by the uncertain and volatile macroeconomic landscape.” Meta’s stock closed up 23.3% on the day.

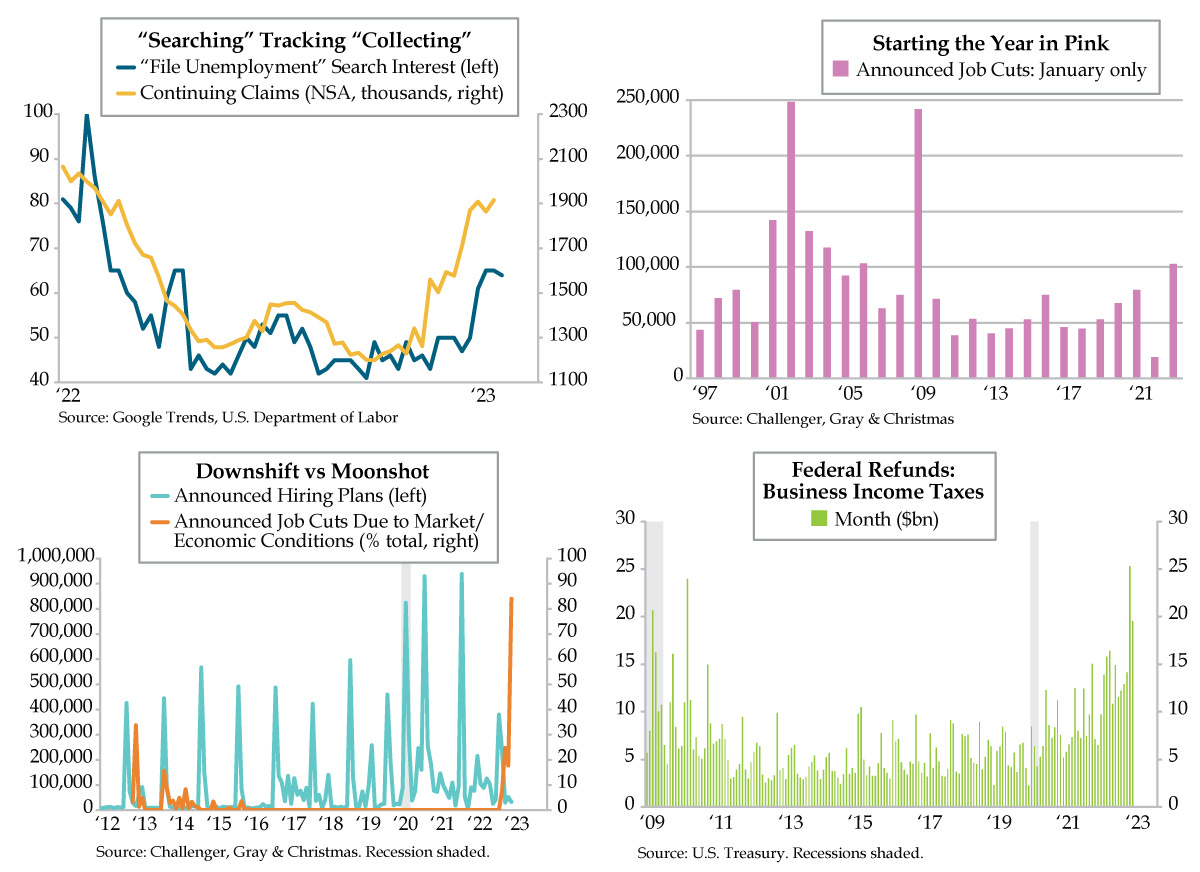

It's true. We’re in crazyland. Just don’t acknowledge it. And whatever you do, don’t breathe a word about the jobs market, especially the inconvenient data that defy headline initial jobless claims. Do not speak to not seasonally adjusted continuing claims, which we updated from Monday’s Feather alongside Google searches for “File Unemployment.” Do not tell a soul that after yesterday’s report, they moved up from last week’s +58% to +60% from their October lows (upper left chart).

Furthermore, do not speak of layoff announcements. As Challenger, Gray & Christmas reported hours before the open Thursday, January layoffs were the worst for this month’s showing since 2009 (upper right chart). You will also be penalized if you speak to crumbling hiring intentions, so do yourself a favor and do not rudely enter into cocktail conversation that, at 32,764, January was the weakest start to a year since 2020, when the U.S. economy was entering recession irrespective of the pandemic to come (aqua line). Furthermore, for heaven’s sake, do not acknowledge the spike off scale in job cuts due to Market/Economic Conditions (orange line) that have no precedent.

Nope, we implore you to stick to the script and ignore that the Department of Labor couldn’t seasonally adjust its way out of a bag. Follow those seasonally adjusted initial jobless claims like the good drone you are. And remember, the U.S. consumer is strong, just as Bank of America’s economics team reminded us yesterday afternoon with regards to the seasonally adjusted annualized rate (SAAR) of U.S., car sales: “New vehicle sales jumped 17.7% to 15.7mn SAAR in January. This was modestly above consensus expectations for an increase to 15.5M SAAR. The increase was largely a function of strong seasonal adjustments in January, which is historically a low month for sales. Indeed, on a not-seasonally adjusted basis vehicle sales fell by 18.6% m/m. Overall, this should provide a boost for personal consumption in January.”

Got it? As for why the raw data were abysmal, we give you today’s lower right chart, with the proviso that you may not make mention of its contents in mixed company. You were raised better than to broach the subject of taxpayer-funded aid packages for the wealthy. As for the U.S. economy’s Voldemort, in January, Uncle Sam robbed U.S. taxpayers of $19.5 to pay slushy business income tax refunds created by a “public health emergency” loophole. We’ve written of this in the past but did not have the full month data for this January until yesterday. Last month’s “collapse” (to the third highest payout month in U.S. history) took the 31-month total since the “program” to claw back taxes you should have paid for your employees began to pay out in July 2020; the $343 billion paid out since then was double the total of the 31 months that preceded it. Call The-Scam-That-Must-Not-Be-Named and add it to a growing list of economic indicators that also qualify as “vol” “de” “mort.”