Ed Rooney: Are you also aware, Mrs. Bueller, that Ferris does not have what we consider to be an exemplary attendance record?

Katie Bueller: I don't understand.

Ed Rooney: He has missed an unacceptable number of school days. In the opinion of this educator, Ferris is not taking his academic growth seriously. Now I've spent my morning examining his records. If Ferris thinks that he can just coast through this month and still graduate, he is sorely mistaken. I have no reservations whatsoever about holding him back another year.

Katie Bueller: This is all news to me.

Ed Rooney: It usually is. So far this semester he has been absent nine times.

Katie Bueller: Nine times?

Ed Rooney: Nine times.

Katie Bueller: I don't remember him being sick nine times.

Ed Rooney: That's probably because he wasn't sick. He was skipping school. Wake up and smell the coffee, Mrs. Bueller. It's a fool's paradise. He is just leading you down the primrose path.

Katie Bueller: I can't believe it.

Ed Rooney: I've got it right here in front of me. He has missed nine days...

What happened next in Ferris Bueller’s Day Off was priceless, as Mr. Rooney watched Ferris’s absences fall from nine to two on his computer screen. If only the real world operated as flawlessly.

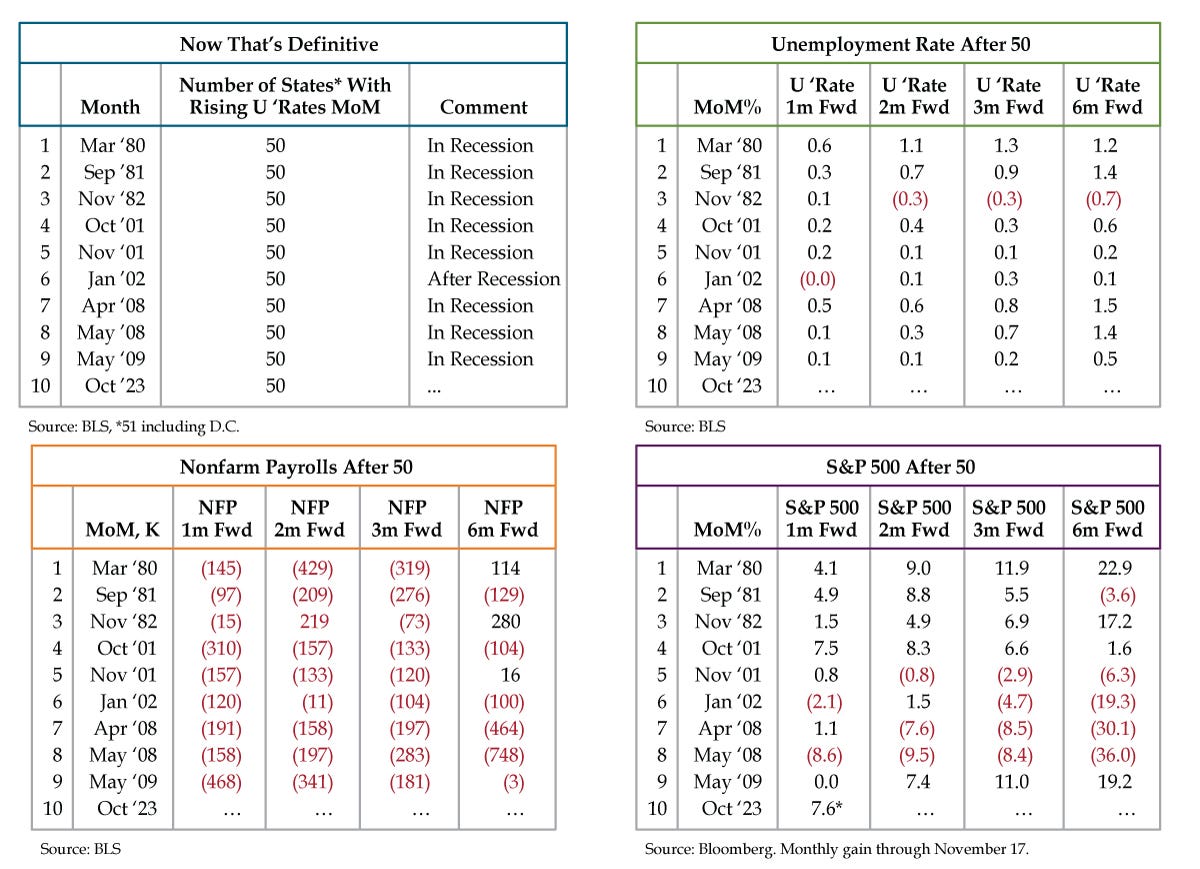

A different kind of ‘nine’ came into focus as we dissected last Friday’s October state jobs data via the Bureau of Labor Statistics (BLS). Around a month ago, with a numerator of 42 and denominator of 51 (including Washington D.C.), we noted that 82% of states had rising month-over-month (MoM) unemployment rates in September. One more month of data in hand and we now tally 50 states with rising unemployment rates MoM, or 98%.

The pandemic aside, since the state unemployment series’ 1976 inception, there have been nine other such instances -- eight of them were during the recessions of 1980, 1981-82, 2001 and 2007-09, while the ninth occurred two months afterthe 2001 recession (top left table).

In theory, we call the Feather a day right here and now. In practice, 2023 has rewritten the rule book. We’ve lost count of the missives we’ve written citing not leading indicators to recession, but rather post-recessionary signposts. To wit, with a hat tip to Eric Basmajian, yesterday’s 19th consecutive negative Leasing Indicator Index (LEI) print track record has only been surpassed in the Great Financial Crisis and the brutal recession of 1974. For good measure, Eric added that the Conference Board’s recession trigger is marked when the LEI’s rate falls below -4.5%; October’s -7.3% marked the 13th in a row beneath this threshold.

Looking back at what’s been a trying year, if it wasn’t for the constancy of the BLS’ negative revisions to the data – private sector payrolls have been revised down for nine months running -- we’d have long since moved on from being dismal to mad scientists.