The Daily Feather — Conrad Cometh

At first blush, I had something in common with Conrad Hilton. We were both born in San Antonio, albeit 83 years apart. Upon closer examination, however, the hotelier was born in the other San Antonio, in the state of New Mexico. Auspiciously, rather than September 17th, he was born on Christmas Day, 1887. At the tender age of 21, he assumed the operations of his father’s general store and won a seat in the New Mexico State Legislature. He then served God and country in World War I. Upon his return, Hilton bought the Mobley Hotel in Cisco, Texas. The rest, as they say, is history…sort of. Hilton’s business – birthing a string of hotels unique in and of themselves, rather than fitting a mold – withstood a body blow during the Great Depression. The survivor formed the Hilton Hotels Corporation in 1946. Near and dear to yours truly, his properties included New York’s Waldorf-Astoria, which he leased in 1949. The Waldorf also happens to be on my former “commute” route to work, from 51st Street between Lexington & Third Avenue to 277 Park Avenue, where Donaldson, Lufkin & Jenrette called home until being acquired by Credit Suisse in 2001.

Last night, I slept at the Los Angeles Conrad, spitting distance from Santa Monica’s St. John’s Hospital, where Hilton passed on January 3, 1979. The occasion was the fifth annual DoubleLine Round Table, where I’ve opined on my view of the economy and financial markets since the event’s inaugural year. Joining me on camera were friends and colleagues Jim Bianco, Jeffrey Gundlach, Charles Payne, David Rosenberg, and Jeffrey Sherman, who I can’t identify as a “moderator” as he’s a giant in the world of credit on his own.

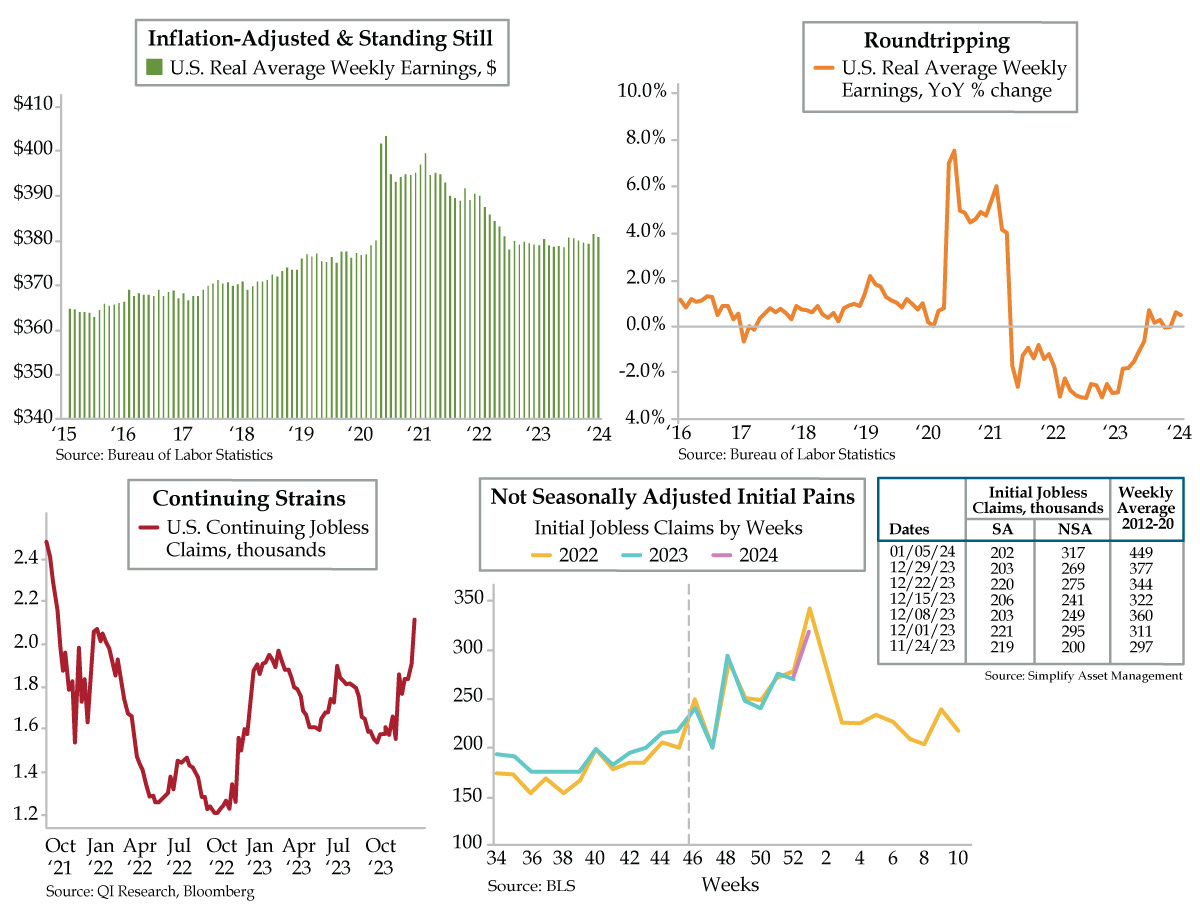

Looking back at the experience, aside from Bianco (who has unique views on the prospects for inflation), what was most unsettling was the ubiquity of viewpoints. Rather than comfort drawn from like-mindedness, an affirmation if you will, I was deeply unsettled by the philosophical ubiquity. We all recognized that inflation was falling too fast. Distressingly, we concurred that the Bureau of Labor Statistics was cooking the books given the ‘boots on the ground’ reconnaissance proffered by C-Suite occupants – cost-cutting will rule the day to ensure bonuses are indemnified. And there was blanket agreement that credit was as rich as a Golden Goose pair of stupidly overpriced, stained tennis shoes.

As for the platinum-plated anecdata gleaned, that came care of a panelist’s ties to one of the nation’s most prolific restauranteurs. Exhibit A) Beware the parade of CEO’s warnings that they can no longer hide behind the ‘de-stocking’ shield to explain top-line anemia. Exhibit B) Absent fresh, at the margin, directly deposited stimulus monies, the mighty U.S. consumer is stumbling hard. Discretionary spending is in the crosshairs.