The Daily Feather — Can the Real Inflation Risk Please Stand Up?

“Droll thing life is, that mysterious arrangement of merciless logic for a futile purpose. The most you can hope from it is some knowledge of yourself—that comes too late—a crop of inextinguishable regrets.”

Joseph Conrad, Heart of Darkness

High school students across America (our former selves included) are made to read the 1899 British novella from which this quote originates, in which fictional sailor Charles Marlow recounts a harrowing journey on a steamboat into the heart of the African continent. At the end of the river, Marlow seeks to make contact with an ivory trader named Kurtz, who has supposedly gone mad and established himself as a god-like figure among the native tribespeople. The story is ambiguous and has been interpreted by scholars in countless ways: to name a few, as a scathing critique of Western colonialism, an examination of the darkness within human nature, and a cautionary tale of the dangers of unchecked power. It has inspired several adaptions, the most famous of which is Francis Ford Coppola’s 1979 film Apocalypse Now which lifts the story out of Africa and into the jungles of Vietnam.

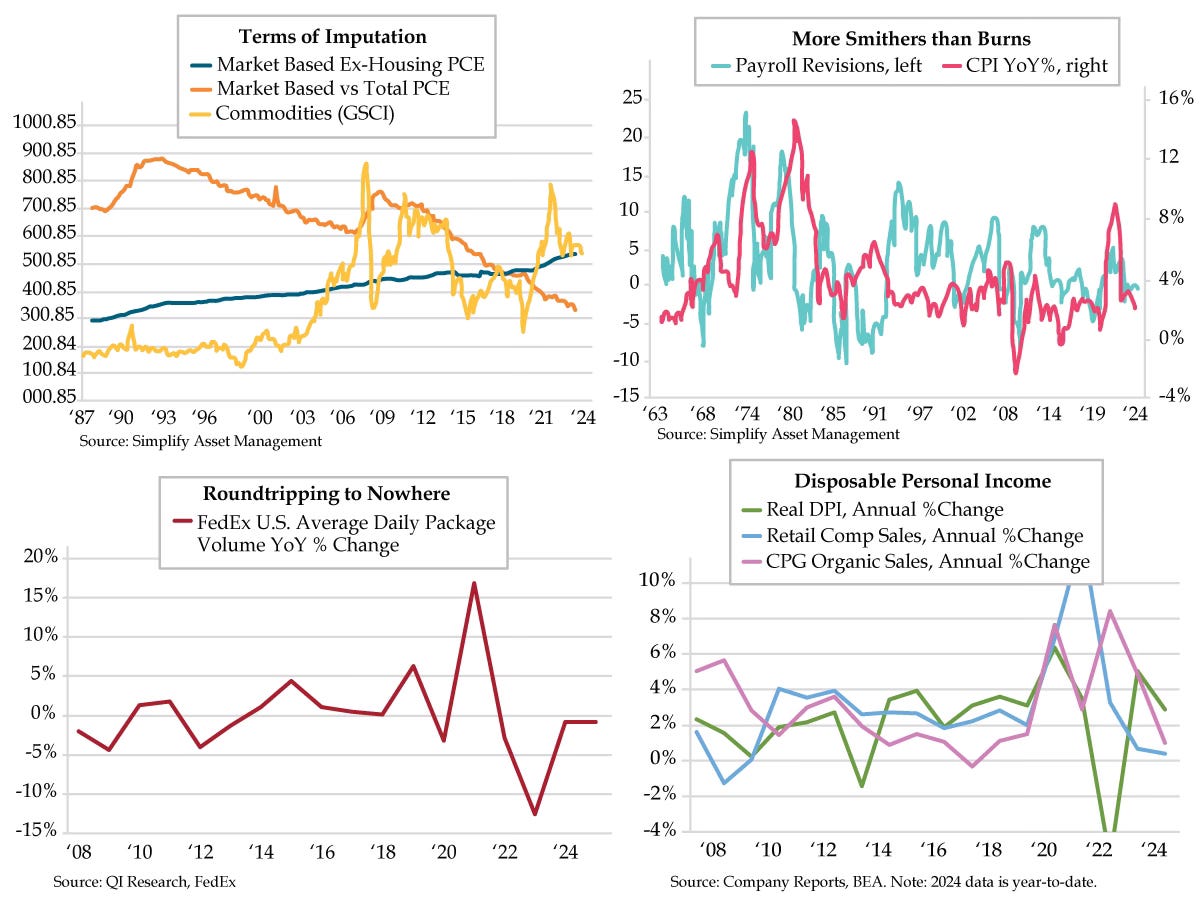

It seems that the most we can hope from government statisticians will be some knowledge of the true underlying weakness of the economy that will come too late… in other words, upon further revision. Until then, we’re stuck with misleading initial prints and Federal Reserve Powell leaning on flawed metrics from the podium. In Friday’s Feather, we noted Powell’s quoting of “market-based” PCE in his post-FOMC presser. While designed to exclude any imputed (read: estimated) expenditures, a glaring exception is housing, for which it makes use of imputed owners’ equivalent rent. Look then at the top left chart, courtesy of Simplify Asset Management’s Michael Green, which plots the ratio of market-based PCE to the broader total PCE metric over time. Notice that it has continually fallen going back to the 1990s (orange line). This steady decline relative to the broader metric, regardless of time period or stage of the economic cycle, reinforces the defective nature of this gauge, which Powell nonetheless referenced while presiding over the FOMC’s worsened inflation outlook for 2025.