The Daily Feather — A Trojan False Sense of Security

As Greek mythology teaches, the Trojan Horse was a wooden structure used by the Greeks in the aptly named Trojan War to enter the city of Troy and emerge victorious. And yet, there was nary a mention in Homer’s Iliad (the poem ended before the war concluded). Furthermore, said horse was only briefly mentioned in the Odyssey. It wasn’t until Virgil’s Aeneid that we got the gory details as such: After a fruitless 10-year siege, the Greeks constructed a huge wooden horse at the behest of Odysseus, and hid a select force of men inside, including the legend himself. To distract, the Greeks pretended to sail away. Meanwhile, the Trojans pulled the horse into their city as a victory trophy. Clever, no? That night, the Greek force crept out of the horse and opened the gates to the Greek army, which had surreptitiously sailed back under the cover of darkness. They thus entered the city and decisively destroyed Troy. The End.

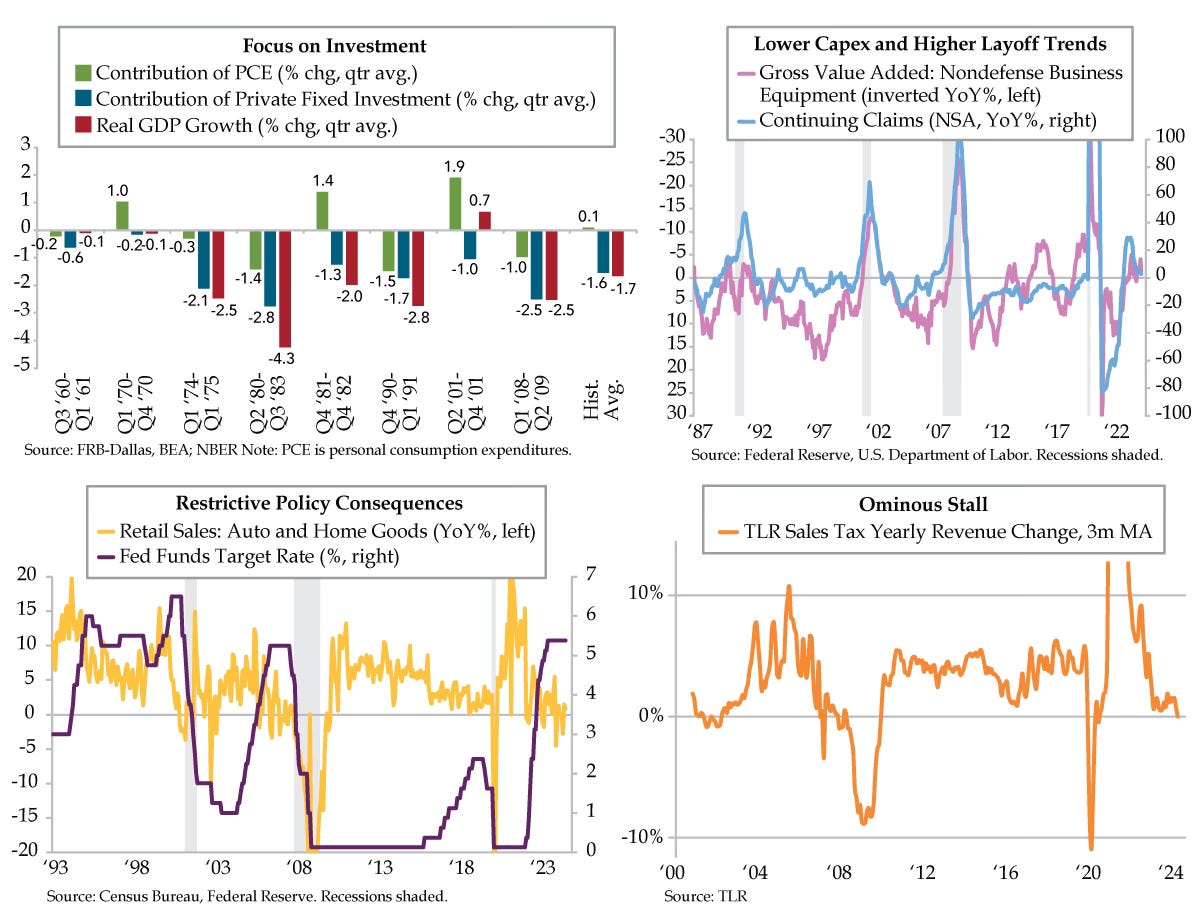

The Trojans are akin to business cycle analysts, basking in a false sense of security. To wit, focusing solely on stock (i.e., levels) when flows (i.e., changes) are flashing yellow or red could lead one astray. Consider the rising share of education and healthcare jobs vis-à-vis total growth in nonfarm payroll employment. Do two recession-proof sectors adding to the labor pool diminish distress elsewhere?

Placing too much emphasis on consumer discretionary falls under the same umbrella. We appreciate that it’s easy to be lulled by impenetrable consumption accounting for two-thirds of the U.S. economy. If the biggest slice of the GDP pie is growing, why angst about a cycle’s ending?