Long before the tennis world had John McEnroe or Hollywood had James Dean, the art world had Caravaggio. The first of many to personify the “bad boy” archetype, the painter was notorious for his skills with a brush that matched his turbulent personality. Caravaggio was a progenitor of the Baroque style, which depicted figures with bold colors, strong contrasts between light and shadow (called chiaroscuro), and emotional intensity. His work would have shocked your average 1600s Italian, which the Catholic church capitalized on. Parishioners flocked to mass to see his paintings adorning sanctuary walls, shrewdly conscripted by the Vatican to keep congregants in pews and from defecting to Protestant denominations. It has been theorized that Caravaggio’s exposure to the lead in his paints drove him mad and expedited his demise. The last years of his life were those of a fugitive, on the run from the law after killing a man. He died at just 38. This past Friday, a major retrospective of the trailblazer’s work opened for viewing at the Palazzo Barberini in Rome. More than 60,000 tickets have already been sold.

Last week in the markets was as unruly as Caravaggio’s temperament culminating with Friday’s jobs report, which did an about-face after Powell’s remarks at Chicago Booth’s Monetary Policy Forum in New York. While he reiterated that “many indicators show that the labor market is solid and broadly in balance,” he was careful to clarify that “if the labor market were to weaken unexpectedly or inflation were to fall more quickly than anticipated, we can ease policy accordingly.”

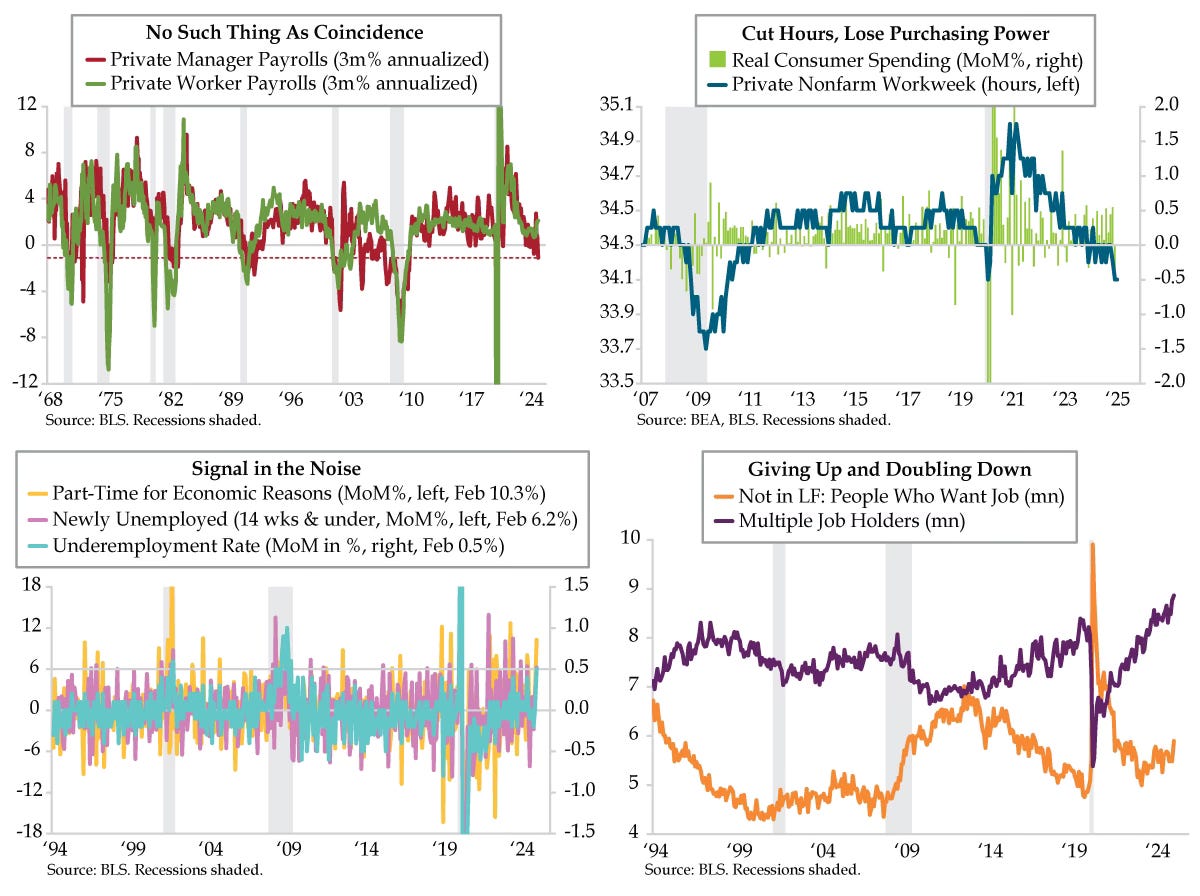

Headline nonfarm (NFP) payrolls disappointed the whisperers, coming in at a gain of 151,000 vs. forecasters’ 160,000 expectation. But the one-tenth uptick in unemployment to 4.1%, which came within 0.011 to rounding up to 4.2%, left investors leaning on Powell’s commitment to pivot (again) if need be. It’s no mystery that with the NFP survey week closing on February 15th, the acceleration in layoff activity in last month’s back half was not fully captured starting with DOGE’s federal job cuts far outpacing the -10,000 captured in February’s report.

Behind the headline’s friendly façade were visible cracks poised to widen in the coming months.