The Crypt-Kicker Five

The Zombies were having fun, the party had just begun The guests included Wolfman, Dracula, and his son The scene was rockin’ all were digging the sounds Igor on chains, backed by his baying hounds The coffin-bangers were about to arrive With their vocal group, ‘The Crypt-Kicker Five’

Struggling and auditioning actor by day, Bobby Pickett’s moonlighting gig was about to make life much easier. Sixty years ago this summer, The Cordials’ lead singer was feeling playful on stage during a gig. While performing the Diamonds’ “Little Darlin,’” Pickett broke out into a monologue in the style of horror movie actor star Boris Karloff. The audience loved it and his fellow bandmembers rooted him on the keep it up. Sensing they were onto something and inspired by the Mashed Potato, a hot dance of the era, Pickett recalled in a Washington Post interview years later, “The song wrote itself in a half hour and it took less than a half hour to record it.” That’s saying something considering the sound effects required taking a rusty nail out of a board to emulate a coffin opening, bubbling water through a straw to conjure a cauldron boiling and dropping chains onto a tile floor to convince listeners those chains were rattling. While released in August 1962, “Monster Mash” appropriately waited until Halloween that year to hit No. 1 on Billboard. At the risk of taking credit where it’s not due, we swiped this theme from Charles Schwab’s Senior Investment Research Manager Kevin Gordon. A meeting with him Friday was the last stop on a whirlwind three weeks on the road for QI. Gordon commented that he, like many of us, has been struggling to pinpoint exactly which part of macroeconomic and financial market history is rhyming in 2022. In the sense that we’re undergoing an energy shock, is this the oil embargo of the early 1970s? On the other hand, we’re also withstanding a food price shock while on the other, other hand, labor doesn’t hold the same sway it did back then over employers. Is this 1989, when the junk bond market spiraled out of control? The answer is no as the issuance market is open. That said, while sales of $41.7 billion thus far in 2022 may be a fraction of the $142.6 billion sold in the same period last year, the potential for a freeze is clearly manifest. Is this 1997? Can one trade set off a daisy chain that reels markets? The Asian currency crisis of 1997 morphed into 1998’s Russian debt default and the same year’s blowup and subsequent bailout of hedge fund Long Term Capital Management. We do know dollars are in such short supply, Nigeria – Africa’s largest economy – has had to pay its dollar debts in naira, their local currency. Is this 2000, when stock market valuations placed investors at existential risk of sustaining major losses (no explanation needed)? Or maybe 2008, when the collateral backing a massive asset class is increasingly questionable (see U.S. corporate debt)? Or possibly late 2019, when world growth was slowing and then rocked by an event (see Russia invades Ukraine)? In querying my Twitter followers, 55% replied that 1979 was the closest parallel, when Paul Volcker was poised to tackle inflation by putting the economy into recession. At 23%, 2000 came in a close second. One last parallel via Sentiment Trader notes the Nasdaq last tacked on four straight days of 1%-plus gains from a 52-week low in April 1980, after which point it tucked in 56% gains through yearend as the U.S. economy exited a 5-month recession that July. Of course, the economy was headed straight back into recession in 1981 and stocks were headed to single-digit price-to-earnings ratio territory, a level of cheapness that’s not been recaptured since. The biggest impediment to making historical comparisons is that there are too many of them. The strong dollar is problematic. But the same can be said of any number of other issues including valuations, inflation, a Federal Reserve that’s in a tightening mode, credit risk that’s rearing its head and slowing global and U.S. domestic growth.

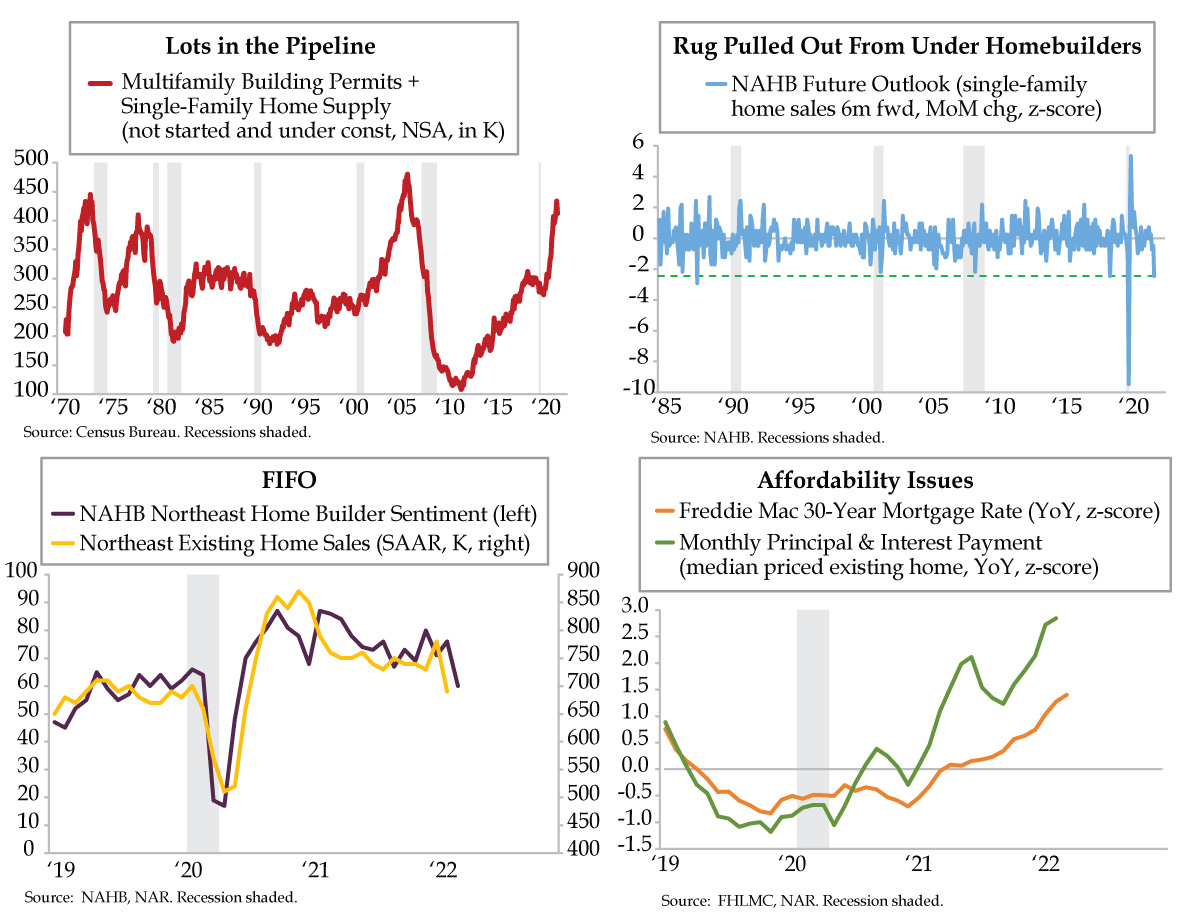

At times like these, leaning on the most tried and true indicators – autos and housing -- can help cut through the cross currents. Per Dealertrack, credit applications to buy a vehicle were down 20% year-over-year; the weekly trend has been weakening. As for housing, today’s graphs paint a picture of a market that’s being attacked on multiple fronts.

The pipeline of single family and multifamily supply has been higher than today in 1973 and 2006 (upper left).

The precedents for homebuilders’ expectations being hit as hard as they were last month number three – December 1987, November 2018, and April 2020 (upper right).

As the headlines blared Friday morning, making that house payment in February 2022 was 28% costlier than it was 12 months prior; mortgage rates’ rise is but one aspect of unmatched historical unaffordability (lower right).

And finally, since peaking in December 2020, existing home sales in the Northeast have fallen 21%; the lagged collapse in homebuilder sentiment has come on with the abruptness of a slap in the face (bottom left).

Housing in the Northeast was the first to benefit from the exodus to the exurbs; logic dictated it be the first to flame out. Housing is as much of a Monster Mash as broader historical backdrop precedents.