Quecha Ch’arki

Is there anything that doesn’t trace back to the ancient Egyptians? This rhetorical-ish question is posed as I ponder how diets have changed in a post-pandemic world. Hibiscus iced tea and Crystal Light Concord Grape are now beverage mainstays. An existence that didn’t feature constant travel left me parched for water substitutes. And then there was the parallel predicament of snacking. Carb-heavy was a no-go. So, I discovered the wonders of beef jerky, the origins of which trace back to the…ancient Egyptians who discovered early on the benefits of the low fat, high protein source of nutrition. Excavated tombs have found the dried meat to be amazingly intact. That said, today’s jerky, in its truest sense, came to be in Peru in the 1550s via the Quechua, a South American tribe who called it Ch’arki, which translates into “to burn meat.” Bake in the sun by day, cool it down at night, serve the preserved meat. Native Americans added the element of smoking the meat in teepees, be that of bison, antelope, or the fish of the day. And finally, cowboys brought salt to the process.

Investors short the market and caught offsides yesterday are licking their wounds. Salt was poured into those gashes midday after a spike took hold that approximately no one can explain. One guess was the Qualcomm effect as it was an Apple supplier that blew out its earnings which implied its semiconductor client would do the same. Another was the GDP construct theory – the breakdown was so transitory as to green-light the realization of full year growth expectations. The conventional wisdom is that GDP should clock in at 2.5% in 2022, on par with 2019’s 2.6%. We say, “Not so fast!”

It was actually anecdata that led us to this quick conclusion. On Amazon’s conference call, Chief Financial Officer Brian Olsavsy said the mammoth firm had expanded too quickly leaving it with an overabundance of warehouse space and too many workers, which will take some time to rectify. Let’s unpack that. Warehouse is the hottest sector in commercial real estate by a country mile. And we’re in the midst of a labor crisis. And yet, Amazon’s mainstay e-commerce revenues (which never lie) fell 3% year-over-year (YoY) to $116.4 billion. Aggregate top line growth came in at its lowest level in two decades. Quietly, Wall Street’s darling reported a net loss of $3.86 billion; that compares to a profit of $8.1 billion in 2021’s first three months.

The idea of layoffs – a word that’s been passe for more than a year – drew me to Bloomberg’s JOBCUTS, a short cut I haven’t taken in some time. I was shocked to see the headline stream was hopping. It wasn’t just the household names – Ford, Twitter, Netflix, and Robinhood; it was the obscure. Genocea Biosciences is letting go of 65% of its staff. Weight-loss app Noom is laying off 495 coaches. And in a scandalous fury, Rembrandt Farms, a chicken farm in Iowa, is laying off 200.

As you know, employment is the most lagging of all economic indicators. Most take solace in Indeed.com’s job postings still being up more than 50% YoY. We’re more concerned that they’ve fallen by 11% since the start of the year. It’s the delta that matters. What we didn’t cite in the above tour through layoff central was mortgage lender and broker headcount reductions, a subject into which we delved deeply in this week’s Quill. With half of the industry in job-cutting mode, we figure you got the memo. One concern, however, was that this sector was the canary.

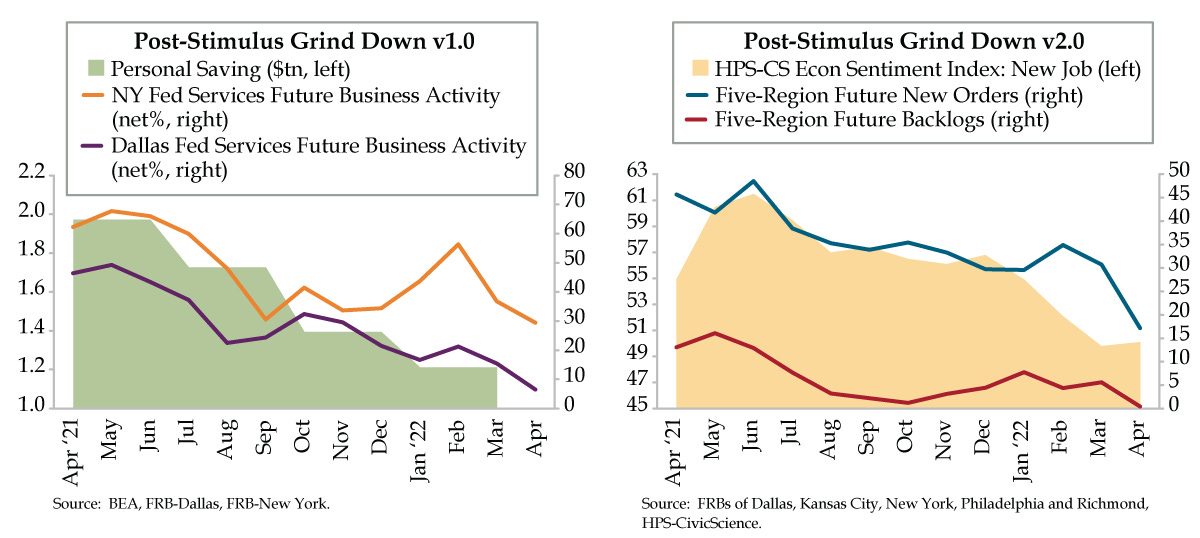

The latest HPS Civic-Science Economic Sentiment data suggest the pallor is spreading. In the two weeks ended April 26th, confidence in finding a new job fell to 50.1, just shy of its post-pandemic low point of 49.8 and appreciably down from July 2021’s peak of 61.5 (beige shaded area). Plotted against the aggregate of five regional Federal Reserve manufacturing surveys’ future new orders (blue line) and future backlogs (red line), it makes sense that firms are downsizing their workforces in anticipation of faltering demand.

A corollary can be drawn on the services side of the economy. We wish the San Francisco Fed would wake up to the need to provide constant installments of data for the 12th District which happens to contain the nation’s largest economy. In the (obtuse) absence of such a luxury, we’ll settle for the service economies of the second and third largest state economies – those of Texas and New York. Today’s charts purposefully depict the period that begins with the last of three stimulus checks. Through the prism of that contained timespan, we see that the outlook for future business activity in the Lone Star State has tumbled (purple line) while that of the Empire State, the country’s largest services economy (orange line), has followed suit from a higher starting point.

As for the fuel to propel spending, we suggest you not bank on the “pent-up savings” narrative. The drawdown in savings (green shaded area), which lands the aggregate rainy-day fund of U.S. households to a lower level that which preceded the pandemic, has been nothing short of Biblical. We would add that this has taken place against a backdrop of unbridled credit card spending. As opposed to 16th century Peruvians, it’s clear U.S. consumers have no intention of socking away provisions for leaner times.