Mr. James Has Left the House…Again

VIPs

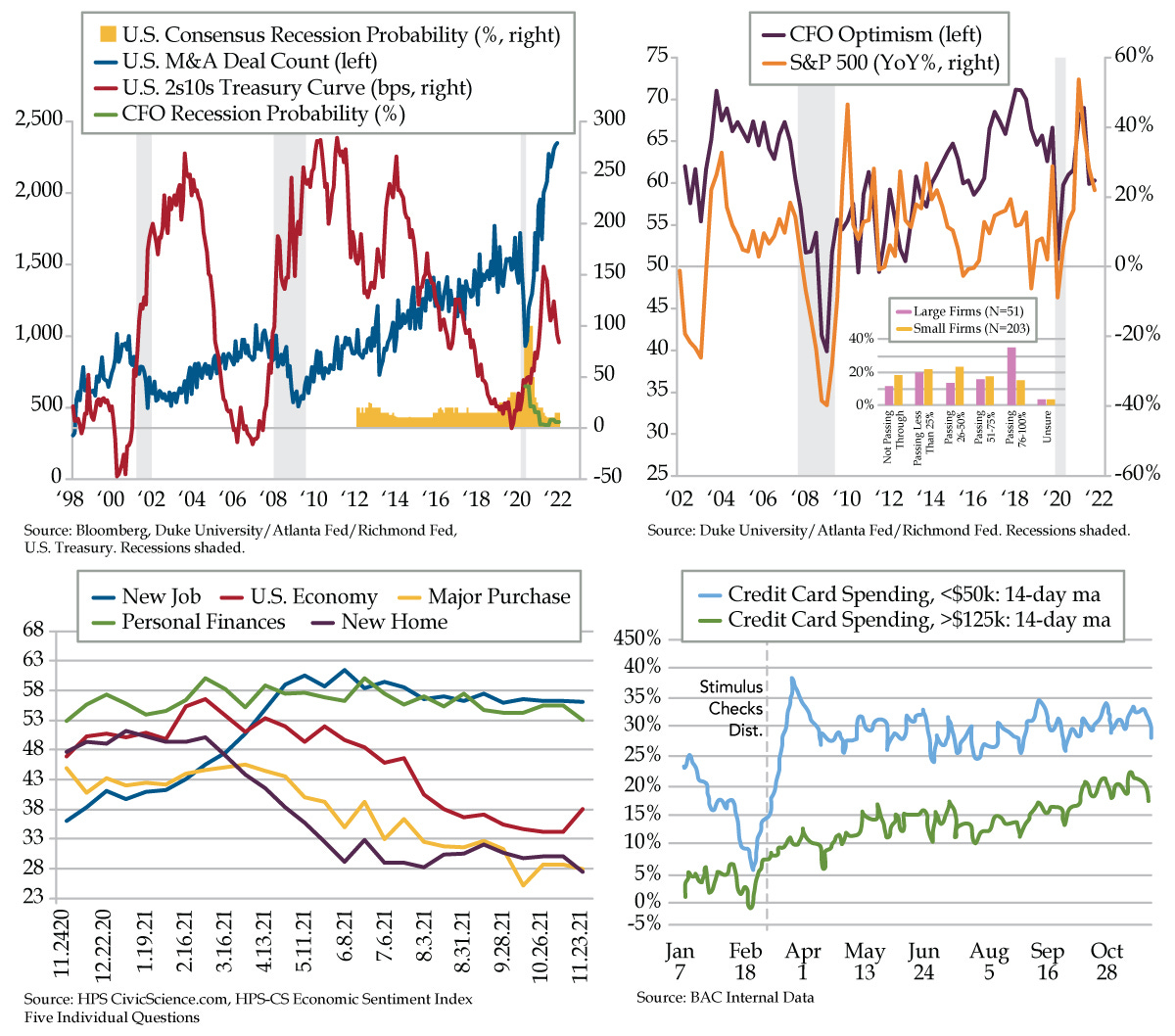

CFO Optimism, per Duke University and the Richmond and Atlanta Feds, is back to moving in lockstep with the S&P 500; upward pressure on wages will be sustained so long as the nation’s largest companies have the capacity to pass on massive price hikes to consumers

Per BofA, credit card spending for those making above $125,000 has retracted, copying the trend of those making below $50,000; as Powell and Yellen retire “transitory”, it’s likely that consensus recession probability is overly optimistic in the face of a flattening 2s10s curve

Civic Science’s residential real estate index fell 2.7 points this week to an all-time low of 27.4, with low supplies cutting consumer sentiment; confidence in personal finances also fell 2.4 points to 53.1, reflecting supply chain issues and inflation worries going into the holidays

Merriam Webster defines independent as “freedom from outside control or support.” In 1959, three graduates of Harvard Business School raised a half million dollars in start-up cash and collateral to buy a seat on the New York Stock Exchange and open an office on Wall Street with a staff of three – William H. Donaldson, Richard H. Jenrette and Dan W. Lufkin. Rather than the retail investor sought after by Mother Merrill and the behemoth’s competitors, the research boutique pursued institutional clients such as banks, mutual and pension funds and insurance companies with the weapon of independent research, a novel concept on the sell-side in that era (and today). Bones were made with reports on what we refer to today as small cap growth stocks. As legend has it, a survey of Donaldson, Lufkin & Jenrette’s 51 top stock picks between 1960--63 found that the firm had beat the Dow Jones Industrials by more than 50%. The firm’s watershed moment would not arrive until 1990, when the firm hired 20 former investment bankers from the defunct Drexel Burnham Lambert.

Some six years on, DLJ's stock underwriting ranked 4th, up from 15th inside a decade. And the firm was selling a fifth of all new junk bonds issued, up fivefold from 1989. That was also the year that yours truly started at DLJ though I interviewed at 140 Broadway before the relocation to 277 Park Avenue. Notable alums include, alphabetically, David Einhorn, Ken Moelis, Paul Singer and Steven Schwarzman. The individual that left the biggest impression on me, or at least had the ability to make the temperature in the room drop by a dozen degrees when he entered the room, was one Hamilton E. “Tony” James who brokered the sale of the firm to Credit Suisse at the top of the market in 2000 for $11.5 billion. Sixteen years later, the Swiss giant took a $3.8 billion write-down on the sale. The lack of non-competes proved decimating to the value proposition. James knew it.

Yesterday, after a storied second 20-year career, the announcement arrived that James would be leaving Blackstone. Rightly color this Italian superstitious, but hitting the bid is an art for “Tony.” He marked the top of the dotcom era by cashing out. Can lightning strike twice for this rainmaker?

Bolstering the case for James having topped the market not once, but twice, were comments by Treasury Secretary Yellen yesterday, who purported that the Federal Reserve was duty bound to prevent a wage inflation spiral. (Now?!) She echoed Fed Chair Powell stating that she too was “ready to retire the word ‘transitory,’” adding, “I can agree that that hasn’t been an apt description of what we’re dealing with.”

To respect decorum, the nation’s Chief Financial Officers would politely agree with the fair chair if they were in the same room. If they were amongst themselves, they’d reply, “No sh*t.” Given antitrust is a relic in America, we can at least breathe a sigh of relief that the biggest companies can pass along twice the inflation as that of their smallest peers (barely discernible lilac and tangerine bars in upper right inset). If nothing else, topline CFO Optimism (purple line) is once again moving in lockstep with that of the S&P 500 stock index (orange line). As long as stocks remain near all-time highs, the pink slips will remain in the top righthand drawer.

The curiosity is that credit card spending among those making more than $125,000 has followed down that of those making $50,000 or less, as you see in the bottom righthand chart. With stocks within a whisper of their all-time highs, the reticence comes down to the anecdata rather than its hard counterpart. Dealer lots are refilling at about the same speed “Price Reduced” signs are procreating in neighborhoods across America.

The beginnings of disruption in interest-rate sensitive sectors helps explain why our new favorite pulse on household sentiment via Civic Science (CS) is at the second lowest in the series’ history back to 2013. Most notable is the read on residential real estate (lower left purple line). Per CS, “As Americans continue to grapple with a housing shortage, confidence in the housing market dropped 2.7 points to an all-time low of 27.4. Also driving this week’s decline in economic sentiment was falling confidence in personal finances (lower left, yellow line), which fell 2.4 points to 53.1—likely a continued reflection of supply chain issues and inflation worries heading into the holiday season.”

Fed and Treasury officials’ joint acknowledgement that inflation now trumps their (formerly) optically politically correct objective of “maximum inclusive employment” is the game changer investors don’t know how to assimilate. We suspect that when the chips finally fall, CFO’s confidence in their companies’ impermeability and Street economists’ recession probabilities will be regarded as having been overly optimistic while flattening yield curves are revealed to have been late 2021’s truth tellers.

But let’s not be overly harsh on the consensus. It's difficult to see the forest for the trees when the soothsayers are members of the tony cohort behind Bain & Company’s forecast that sales in the global luxury goods sector hit a record $325 billion this year. Hitting that bid is likely why Mr. James is no longer in the House, having perfectly timed an exit for the second time in his career.