How to Survive a Charging Rhino

VIPs

The U.S. hotel occupancy rate rose to 61.8% the week ended May 29, the highest level since February 2020, per Smith Travel Research; despite the resurgence of leisure travel, the path to recovery remains volatile without business travel helping make up last year’s lost ground

TSA throughput of 1,984,658 this past Sunday was 4.5 times 2020’s 441,255, but still 26% below 2019’s 2,669,860; per lodging data from Citi, leisure markets such as Miami and San Diego outperformed through the pandemic while cities like D.C. and NYC underperformed

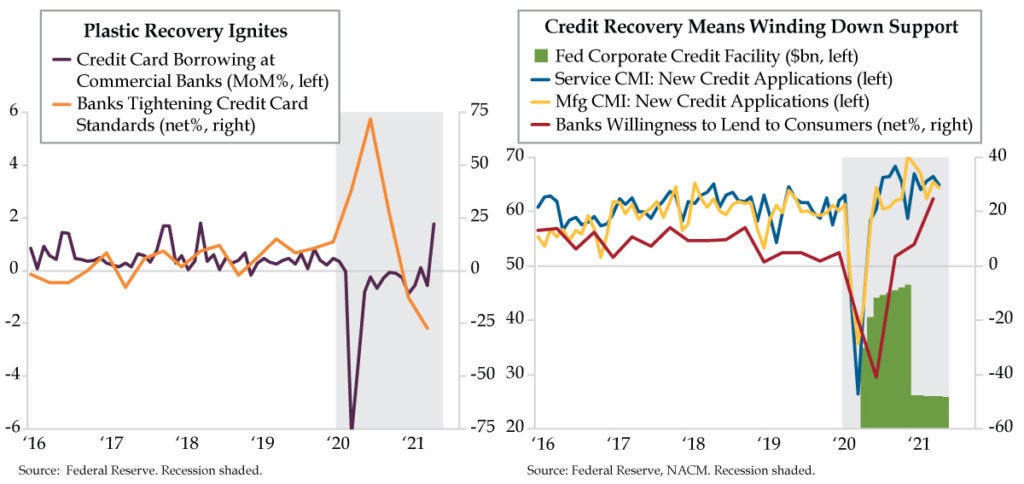

Credit card lending standards eased by 65.6 points from Q3 2020 to Q2 2021, the strongest upturn since the 1970s, per the Fed’s Senior Loan Officer Survey; the 1.8% monthly advance in credit card borrowing at commercial banks validates the recovery in discretionary spend

It’s one of the oldest cringe-worthy yarns in the book: “How do you stop a rhino from charging? Take away its credit card.” Instead of bad jokes, we would prefer to provide you with life-saving tips should you decide to go on safari this summer. Here are five from a rhino guardian and anti-poaching team leader from the Save Valley Conservancy in Zimbabwe: 1) Rhinos do not give warnings or make mock charges – when a rhino makes a decision, it always follows through; 2) Rhinos can cover 30 meters (about 90 feet) in just three seconds – do not mistake them for heavy or slow; 3) You have three seconds to get out of a rhino’s path, so move sideways, not backwards; 4) Identify all suitable escape trees near you within three seconds’ distance at all times in case you get into trouble; 5) Make sure your escape tree is sturdy enough – a furious rhino may simply push down a smaller tree. Bonus fashion safety tip: Rhinos may be color blind, but they react to red and white, so avoid wearing these colors.

With top-line travel data normalizing, it's clear we’re out and about, so may as well be prepared. Weekly hotel metrics from industry standard Smith Travel Research (STR) revealed that the U.S. hotel occupancy rate rose to 61.8% in the week ended May 29, the highest level since the pre-pandemic week ended February 29, 2020. STR noted that while support for leisure demand is solid as we transition into summer, “the path to recovery remains a rollercoaster with a lack of business travel, both domestic and international, preventing hotels in many markets from making up more of the ground lost in 2020.”

Once again, 2019 comparisons are most useful at these junctures. Helpfully, Citi’s lodging team digs into the details by chain scale and market every week. True to a pattern first established with truck drivers never abandoning the open roads, nor the motels along them when the pandemic first hit, performance was led by Economy properties. This was followed by Midscale, Independents and Upper Midscale properties. Victims of battered business travel, Upscale, Luxury and Upper Upscale lagged. By market, big urban centers – Washington, D.C., New York, Chicago, Boston and San Francisco – underperformed, while key leisure markets – Miami, Phoenix, Tampa and San Diego – outperformed. Know any good zoos in that last city?

In keeping with the 2019 vs. 2021 theme, TSA throughput of 1,984,658 this past Sunday was 4.5-times that of 2020’s 441,255. Though Sunday’s air traffic was a post-pandemic peak, it remained 26% below the 2,669,860 clocked that same day in 2019.

Discretionary spending, especially that of the travel and tourism ilk, tends to be charged on credit cards by U.S. consumers. Nerdwallet notes multiple benefits to charging your vacation on a credit card even if you’ve got the money set aside to cover the trip. Rewards points, miles or cash back are three enticements for holidaymakers while some cards offer valuable travel protections too. Besides, it’s convenient and safe to use a credit card because then you don’t have to track down an ATM or a currency exchange if you’re overseas.

Yesterday’s Consumer Credit report from the Federal Reserve was too dated to provide an updated snapshot of credit card borrowing; it’s time stamped April 2021. Therefore, we tapped the Fed’s weekly commercial bank assets and liabilities report to overlap with STR’s real time data. May’s preliminary 1.8% monthly advance attests to the recovery in plastic usage reaching ignition sequence (purple line).

Prior to liftoff, bankers had already signaled confidence in the release of pent-up demand. The Fed’s Senior Loan Officer Opinion Survey showed credit card lending standards eased by a record amount in 2021’s second quarter (orange line), setting the stage for the rotation away from goods and toward services.

The lending standards cycle also has been compressed relative to the past two cycles. After the 2001 and 2007-09 recessions, it took three years and two years, respectively, for loan officers to arrive at net easing. The COVID recession saw the full roundtrip take place in under one year. Banks’ willingness to lend to consumers (red line) improved a combined 65.6 points from 2020’s third quarter to the second quarter of 2021, the strongest recovery signs since the 1970s. But this was not a precursor to the optimism on display by credit managers.

Granted, there is a dash of survivor bias in the National Association of Credit Management’s (NACM) credit manager survey. However, the sustained expansion, reinforced in NACM’s late-May release, in both the manufacturing and service credit managers’ indices (CMIs) for new credit applications (yellow and blue lines) suggests that the recovery in business conditions is well underway. Credit apps are considered the most leading of indicators from the NACM survey. It didn’t hurt that revenues in both sectors pierced the 70-threshold in the three consecutive months through May.

With the U.S. economy charging forward like a rhino and multiple signs of credit recovery, the Fed’s unannounced announcement of the wind down of the Corporate Credit Facility on June 2nd gave more credence yet to faith in the recovery. By the end of May, U.S. recession probability had fallen to 10%, or if you prefer, a 90% probability of expansion. The double-edged sword is that such high conviction red flags high valuation risk and the potential for financial conditions to meaningfully tighten.