Hope Week

VIPs

Retail foot traffic was down 28% from 2019 levels this Black Friday, with six in ten shoppers starting their holiday shopping before Thanksgiving this year; meanwhile, online shopping fell to $8.9 billion from 2020’s $9 billion, per Adobe Analytics, the first decline on record

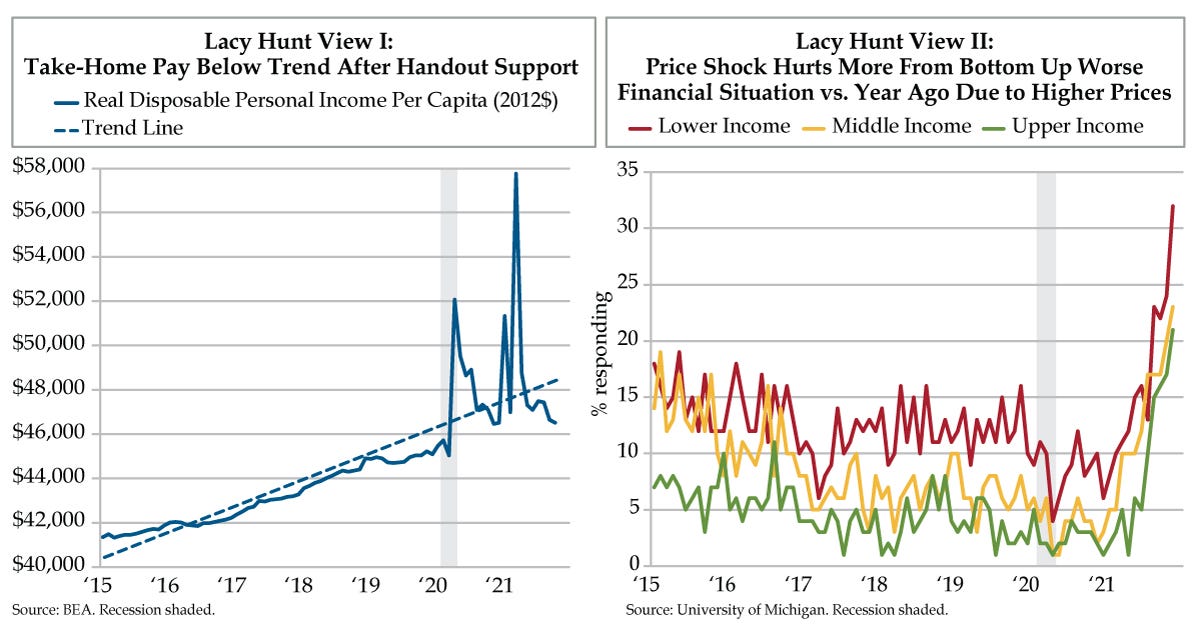

While Adobe predicts Cyber Monday sales of $11.3 billion, the National Retail Foundation expects holiday sales to rise 8.5-10.5% YoY; with just 21% of upper income earners facing sticker shock vs. 32% of lower income earners, the wealthy should drive holiday spending

Real disposal personal income per capita has now fallen below trend, per the BEA, round-tripping to November 2020 levels; instead of inflation falling in the lead-out of a recession, stimulus helped to accelerate price increases while preventing wages from keeping pace

‘Tis the Advent Season for Christians the world round. We know that because yesterday was the Sunday closest to November 30th, the feast day of St. Andrew the Apostle. There are three more Sundays of Advent, which translates to “the coming” in Latin. Observed since the fourth century, the purpose of the lead up to Christmas was originally a time of reflection for converted Christians to be baptized on Christmas. For several subsequent centuries, Advent was similar to Lent, with Christians praying and fasting until December 25th. The Advent we grew up with does anticipate the Nativity and features a wreath. The wreath’s three purple candles symbolize hope, peace, and love. These candles are lit on the first, second, and fourth Sundays of Advent and are so colored because purple was so costly in the 16th century, it was associated with royalty, which suits the King of Kings. The rose candle, which symbolizes joy, is lit on the third Sunday.

At yesterday’s 9:30 am service, the first of three purple candles on the wreath inside the pulpit were lit. The senior pastor’s sermon was an eloquent plea to devote our hearts and minds in the coming days. We doubt the advent calendar in his house features characters from The Office or Baby Yoda. But we can tell you such items can be added to your cart in this season that worries the right reverend. As is the case with his of-the-cloth counterparts, the overarching concern is that this holy season has become too far distanced from faith and grace; for many, these lamentations are the first we recall of our church going days.

By the looks of the preliminary headlines, Americans are either becoming more devout this holiday season, or buying less because they can’t maintain their pre-pandemic spending levels. The explanation for foot traffic at brick-and-mortar stores being 28% lower than 2019 levels is that shoppers’ trees, which have been conspicuously twinkling in neighborhoods since Halloween, already have piles of gifts underneath them. In the same spirit manufacturers are stockpiling inventories, gift givers have just-in-case holiday shopped to preempt “out of stock” moments given all of those container ships stuck off west coast ports. Per the National Retail Federation (NRF), which at $84.1 million, was the top-ranked lobbyist in the United States in 2020, six-in-ten consumers had started holiday shopping before Thanksgiving this year.

Adobe Analytics splashed out with news that online shopping had dipped to $8.9 billion this Black Friday, down from last year’s record $9.0 billion, the first decline on record. In addition, at $5.1 billion, Thanksgiving Day shopping was flat on the year. The two-day combined decline year-over-year (YoY) was also a first.

Today, however, is expected to be a record Cyber Monday, with Adobe forecasting $11.3 billion in sales. In all, the NRF expects combined November and December holiday sales of between $843 and $859 billion, up 8.5%-10.5%, which would set a YoY record for growth.

As an aside, Amazon is leading the charge by slashing the price of Apple’s new Air Pods Pro by $70 to $179. At $18.7 million, the online monopoly was “only” the 8th biggest lobbyist last year. And for those of you worn thin from having your privacy infringed, for as much as the other monopoly, Facebook, is called to the Hill to optically placate the masses, at $19.7 million, it was the 6th biggest lobbyist in 2020.

Sunday evening’s buoyant futures opening for stocks suggests investors agree that consumption will hold up. We certainly concur that the highest income earners are splashing out as we’ve been documenting with anecdata and see validated in the latest batch of data from the University of Michigan. As the green line shows, only one-in-five upper income earners are price-shocked, appreciably less than nearly a third of lower income earners who are in price shock.

In Saturday’s Intelligence Briefing, we quoted Dr. Lacy Hunt, a QI mentor’s observation that “inflation is shredding the budgets of about 75% of our households.” He was quoting September data in the discussion we’d had a few weeks back. With Friday’s data on per capita inflation-adjusted disposable income (blue line) in hand, we now know even more Americans are falling behind. Absent Stimulus Check 4.0, take-home pay has fallen below trend and has round-tripped to levels that prevailed in November 2020.

Per Hunt, the stimulus has thrown off the formula needed to ensure an economy can adjust as it exits contraction: “For the first three or four years after a recession, historically inflation has continued to decelerate. In disinflation, prices rise more slowly than wages and real incomes rise, interest rates fall, and the current account deficit improves. This is needed for real wage income to rise, interest sensitive sectors to expand and for the drag from the trade deficit to diminish. With the acceleration of inflation thus far this year, these three essential requirements of a reinforcing expansion are not being met. Prices have risen faster than wages, causing real wage income to fall, the interest sensitive sectors have turned down and the current account deficit has widened.”

We know the Omicron variant was blamed for the thumping the S&P 500 took last Friday, the worst post-Thanksgiving showing in 80 years. Perhaps the market is also sniffing out the widening pool of stretched U.S. households who know that even in the season of Advent, hope is not a strategy.