From Monterey to Morro Bay

In 1887, New Yorker John L.D. Roberts, M.D. bought land from an uncle on the California coast and founded the town of Seaside. In his capacity of a rural country doctor who made house calls on horseback, he found himself pining for a road that could expedite his journey to his patients. Desire became need on April 21, 1894. Dr. Roberts was summoned to come to the aid of the injured survivors of the S.S. Los Angeles, which had run aground on the rocks near Point Sur, 21 miles south of Carmel. The horse-drawn cart ride stretched on for 3 ½ hours prompting Roberts to convince State Senator Elmer Rigdon that a road could be constructed for $50,000. While it took some time, the project was finally approved in 1919. San Quentin State Penitentiary erected three temporary work camps to provide needed labor for a wage of 35 cents a day. Locals, including John Steinbeck, also worked on the road. The hardest worker, though, Swedish chemist and engineer Alfred Nobel, as in the prize, who patented dynamite in 1867, 70,000 pounds of which blasted through 10 million cubic yards of the steep cliffs overlooking the Pacific.

Like the cotton gin that preceded it, dynamite reduced costs by replacing expensive and slower workers with innovation, the march of which has yet to be arrested. On Wednesday, I was in Los Angeles to participate in DoubleLine’s fourth annual Round Table Prime. Amidst the bomb cyclone pummeling the state with rain, I was not surprised to learn that the patch of Highway One Dr. Roberts championed constructing at Big Sur was closed until the risk of mudslides passed. I was, however, shocked to be introduced to Artificial Intelligence (AI), QI-style. When asked to write a two-paragraph description of Federal Reserve chair Jerome Powell’s prized (read: flawed) JOLTS data, ChatGPT cranked out a product that was cogent and highly readable. Before you ask if what you’re reading was written by AI, I’ll stop you with one word: “Please.”

That said, the capacity for AI to blast dynamite through the labor input of the college-educated, white-collar workforce is immeasurable. Forget about work from home, ChatGPT wrote a passing AP Literature essay. The implications for paralegals, accountants, research firms, consultancies, accountants, low-grade code writers – you name it – are profound. It goes without saying that recession will expedite the adoption of AI.

As we expected, the Fed’s unrelenting tightening campaign is catalyzing a galloping start to layoffs in 2023. The 154,329 job cut announcements in last year’s fourth quarter are but an appetizer. Commenting yesterday on the highest three-month tally since 2020, Andrew Challenger of Challenger, Gray & Christmas said, “Clearly, interest rate hikes and inflation impacting the housing market are causing companies in Financial, Real Estate, and Construction to lay off workers.” That is, of course, on top of the technology sector that can’t seem to get through one round of headcount reduction before announcing the next, all of which are pricey with billions in severance being racked up. And then there’s retail. As of the end of 2020, Bed Bath & Beyond had 55,000 employees. Last year’s closures of 150 store locations accompanied a 20% reduction of the beleaguered retailer’s workforce. We will soon enough know how many more jobs will be lost in its bankruptcy process.

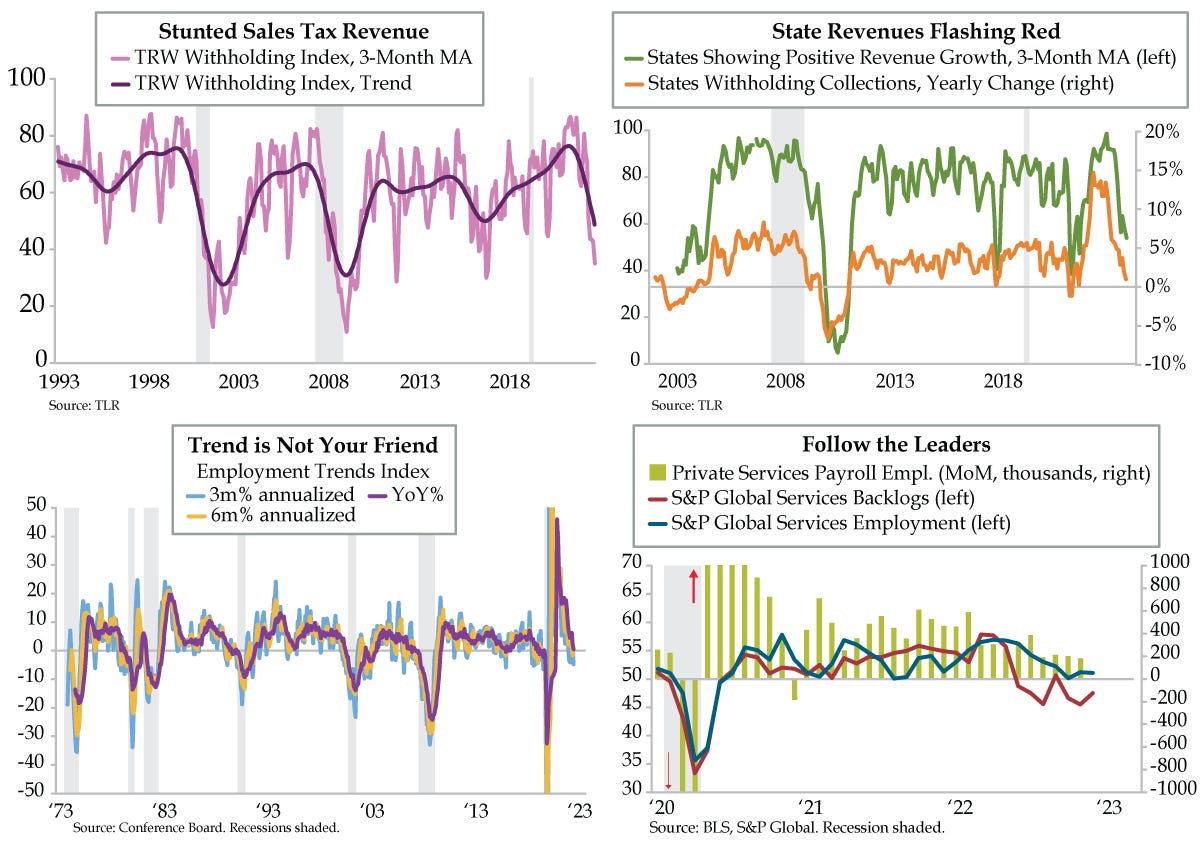

We would also note that after taking a breather on New Year’s Eve, the first five days of 2023 have seen 67 more announced closings per DailyJobCuts.com. The toll on small businesses will only rise given what state tax revenue officials are witnessing. QI dear friend Philippa Dunne tallies what’s collected one state at a time. In November, 29% of states met or exceeded their withheld tax collections; that percentage fell to 24% last month. On a three-month moving average, this metric is in recessionary territory (lilac line). Ditto for the number of states reporting positive revenue growth (green line). Meanwhile, the average YoY miss widened to -5.6% last month from November’s -4.5% (orange line). Dunne warned that, “Monthly tax receipts are noisy, but two months of quite sudden weakness, and comments by many of our contacts about weakening, and about the current divide many are seeing between receipts and the official payroll statistics raise real concern.”

In addition to the better known Leading Economic Index, the Conference Board produces a leading Employment Index (ETI). Per the CB, “November’s decrease in the ETI was driven by negative contributions from six of eight components including: Initial Claims for Unemployment, Percentage of Firms with Positions Not Able to Fill Right Now, Industrial Production, Number of Employees Hired by the Temporary-Help Industry, Ratio of Involuntarily Part-time to All Part-time Workers, and Real Manufacturing and Trade Sales.” The ETI is on the cusp of turning negative on a year-over-year basis and has already done so on a three-month and six-month annualized basis (lower left chart). Tack that indicator on the pyre.

And finally, as investors transfixed on yesterday’s seasonally distorted jobless claims (continuing remain up 30% over their May low), S&P Global quietly reported that backlogs (read: future demand) in the services sector remained in contraction in December (red line) while employment ticked closer to contraction (blue line). Outright contraction in service sector payrolls is in train (green bars). Given withholding is “really weakening faster than expected,” Dunne expects a below consensus 50,000 nonfarm payrolls print when the data cross tomorrow and for the unemployment rate to tick up to 3.8%. Even if she’s right, it won’t be enough pain inflicted for Powell.